As a professional photographer, the entire world is your job site, from weddings and editorial photoshoots to private events and landscapes around the world.

New adventures and busy sets come with inherent risk, whether it’s a bodily injury while shooting on location, a miscommunication around a deliverable deadline, or third-party property damage. (Not to mention if something happens to your state-of-the-art camera equipment!).

To protect yourself from the financial consequences of work-related accidental damage, you need photography insurance. But how much does photographer insurance cost? Read on for a budget snapshot.

How much does photography insurance cost?

The exact cost of photography insurance varies due to several factors, just like every photographer has a unique eye for composition and signature style. Whether you’re shooting down the street or across the country, or whether you own or rent your cameras and gear, the most significant cost factor is the type of insurance coverage you choose.

There are three types of insurance that all photographers should purchase:

- General liability insurance

- Professional liability insurance

- Camera and equipment insurance

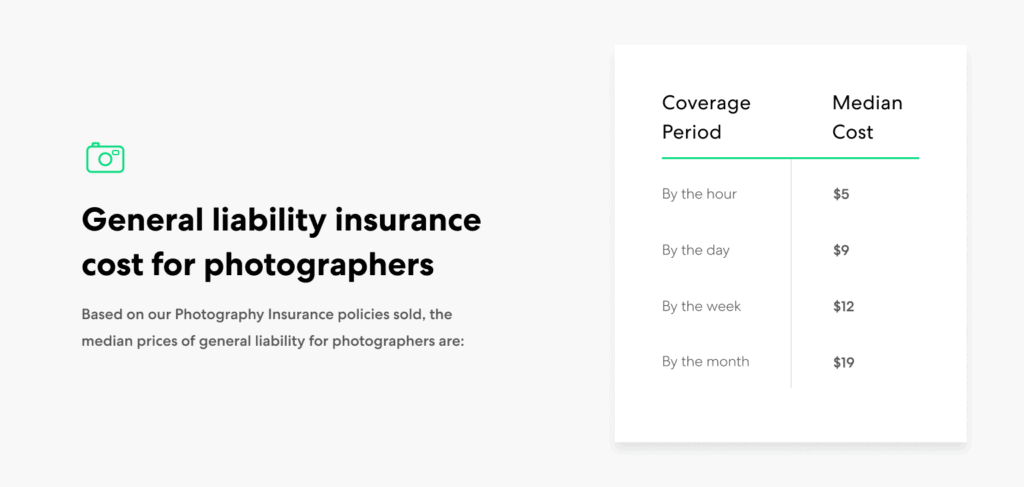

General liability insurance cost for photographers – Based on our Photography Insurance policies sold, the median prices of general liability for photographers are:

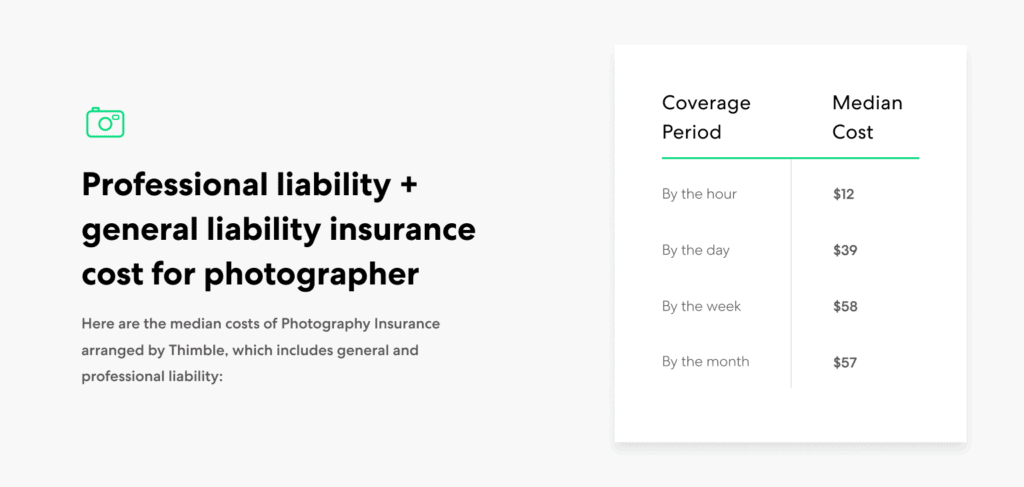

Professional liability + general liability insurance cost for photographers – Professional liability without general liability leaves you exposed to claims of errors and omissions related to your professional services or advice that result in a client’s financial loss. Thus, most photographers choose to bundle both coverages together in one policy. Here are the median costs of Photography Insurance arranged by Thimble, which includes general and professional liability:

Camera equipment insurance cost – Thimble’s Business Equipment Protection covers the photography equipment that travels with you from jobsite to jobsite. Based on our data, the median monthly cost is:

- $6 per month for $1,000 coverage limit

- $15 per month for $2,500 coverage limit

Photography is considered a relatively low-risk profession, especially compared to jobs such as general contractors, so you can expect lower premiums when it comes to liability. However, as a photographer, you’ve likely invested quite a lot in the cameras and gear you need to succeed, so you may spend more to protect your equipment.

Why do photographers need liability insurance?

General liability insurance is an essential type of business insurance, especially for professionals who interact with third parties (like clients or models) in various locations (like studios, venue halls, and the outdoors). It protects you from the financial consequences of mishaps related to your work. Check and double-check.

Setting up the photoshoot, framing the perfect shot, and snapping the actual photos are only one part of your average workday. You still have to edit, retouch and deliver the final content, plus negotiate contracts and projects. If a client claims that a mistake made by your business resulted in their financial loss, you could be held liable.

This is where professional liability insurance comes in—for the potential errors and omissions that can arise from missed deadlines, dissatisfied clients, unclear expectations, or any other mistakes made in your work. It can provide defense in court and help pay for a client’s financial loss if you fail to provide professional services properly.

We recommend that every photographer get both general liability and professional liability coverage. Thimble makes it all easier to navigate by including general liability coverage when purchasing a professional liability policy. With full coverage, you’ll never have to miss the perfect shot.

How to choose photography equipment insurance

As a photographer, your camera is more than just a piece of equipment—it’s your livelihood. On top of that, you have tripods, lens accessories, rented studio lighting equipment, and more to worry about. If something were to happen to your photography equipment, it could impact your entire business. This gear isn’t exactly cheap to replace.

While general liability protects against third-party property damage, it doesn’t protect your own (first-party) property. For your camera gear and equipment, you need additional coverage. Thimble’s Business Equipment Protection provides protection against theft or accidental damage on the job or while traveling to and from appointments, so you can focus on framing the perfect shot. Also known as inland marine insurance, it covers the equipment that you take with you.

As a photographer, there are a few things to check when buying camera insurance, including:

Your deductible – Your deductible is how much you will pay before insurance kicks in. For instance, if your deductible is $500 and you break a $1,000 camera lens, insurance will cover $500 after you pay your $500 deductible.

What’s covered – Some equipment insurance policies only cover the exact gear listed on your policy. Look for the term “blanket coverage,” which means all your gear under $2,500 is protected even if it’s not listed in the policy.

Coverage limits – How much your insurer will pay for your claim. As cameras and lenses can quickly add up, make sure you choose enough coverage.

What influences photography liability insurance cost?

Snapping photos isn’t always the most dangerous career path, but certain variables will require a slightly higher premium:

Location – Where your photography business is based will change how much you pay for insurance.

Crew size – If you’re operating a small unit of camera-clad warriors, you’ll pay higher rates to insure each member of the team in case you or one of your employees has a work-related accident involving a third party.

Coverage limits – The amount of insurance you need impacts what you pay for photography insurance. A higher limit will cost extra, but it could also save you an additional million dollars or more in damages, especially if you’re working on large or riskier projects

When purchasing photographer insurance through Thimble, choose between a $1 million and $2 million liability coverage limit. According to the coverage limits for professionals in the event and entertainment industry, 87% chose the $1 million coverage limit.

Photographers should also purchase separate coverage for their gear, which has different limits.

For your equipment, Thimble offers coverage limits of $1,000 or $2,500, both with a $500 deductible. As cameras and lenses can be expensive, we also offer an optional added protection for up to two individual $2,500+ items.

Coverage duration – The length of coverage determines how much your insurance costs and impacts your business expenses.

Because photography is usually a gig-based industry, with Thimble, you have the option to purchase insurance coverage for only the jobs and shoots you’re working, rather than the entire year. Need coverage for a few hours or a few days? No problem. Photography Insurance arranged by Thimble can be purchased by the hour, day, week, or month.

What other types of insurance do photographers need?

General liability, professional liability, and Business Equipment Protection are essential for photographers. But they’re not the only types of insurance that help safeguard your business. Consider the following as additional business expenses.

Commercial property insurance – If you operate your own studio, photo lab, or lease an office space, you should consider commercial property insurance. While equipment insurance covers the camera gear that travels with you to jobs, commercial property insurance protects the stationary equipment you keep at your workplace, such as printers and studio tools. Commercial property rates vary based on external factors, including location, the size, age and type of building, and the equipment stored inside.

Auto liability insurance – If you drive to and from shoots daily, the law requires you to have auto insurance. Unless your photography business is listed as the owner of your vehicle title, your personal auto insurance should provide enough coverage. However, it’s worth confirming with your auto insurance provider if you need separate commercial auto liability insurance to avoid any costly surprises.

Workers’ compensation – If your photography business has grown enough to have hired employees, you likely need workers’ compensation coverage. While this depends on the state in which you operate, you’re typically required to purchase workers’ comp to protect your business from the financial consequences of an employee sustaining injuries or illnesses resulting from employment, including medical bills, physical rehabilitation programs, lost wages, and more.

Just point and shoot: Insurance made simple

As a creative professional, you want to focus your time and energy on lighting conditions, lens types, color composition, and artistic expression, not understanding business insurance’s nuances. When it comes to your photography business insurance, you want something quick, easy, and straightforward. That’s why we’re here (for you).

Get full coverage—general liability, professional liability, and even Business Equipment Protection—in just 60 short seconds with Thimble. Click “Get a Quote” or download the Thimble mobile app, answer a few questions, and click to purchase. Your policy and Certificate of insurance will be ready for your next gig. Now, you can get back to what you do best.