As a landscaper, your job involves working alongside Mother Nature to turn outdoor spaces into lush sanctuaries. Your clients appreciate your know-how and green thumb.

Since you work with chainsaws, pesticides, and other potentially dangerous tools, there’s always the risk that your landscaping work could result in physical harm to people or in property damage.

That’s why most landscapers need landscaper insurance. But how much can you expect to pay for business insurance? And what factors into the cost?

In this guide, we’ll cover business insurance costs and benefits for landscapers.

How much does landscaper insurance cost?

The type of coverage your business needs is the biggest factor impacting how much landscaper insurance costs. While there are other factors such as location at play, your premiums are determined mostly by how much and what type of insurance coverage you choose.

Interacting with third parties and their property is a core aspect of any landscaping business. That’s what makes general liability insurance a must-have, and why landscapers often find that general liability insurance makes up the bulk of their insurance expenses.

Usually, general liability (and any business insurance) is purchased for an annual term and paid monthly. At Thimble, we know you need flexibility in your schedule—and don’t need to pay for insurance when you’re not working. Our on-demand Landscaping Insurance gives business owners more flexibility with plans by the hour, day, week, or month when you need coverage during the busier seasons.

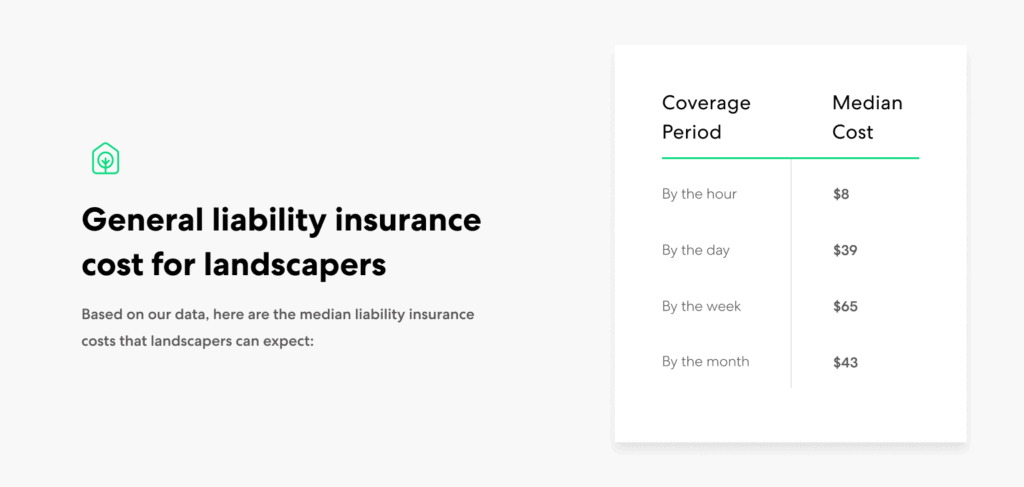

Based on our data, here are the median liability insurance costs that landscapers can expect:

General liability insurance provides coverage for third-party bodily injury and property damage, as well as personal and advertising injury. But what happens if your own tools and equipment are stolen, damaged, or lost? Because tools and equipment are considered first-party property, you need an additional type of coverage known as Business Equipment Protection.

Business Equipment Protection covers your equipment that travels with you from jobsite to jobsite. Based on our data, the median monthly cost is:

- $6 per month for $1,000 coverage limit

- $15 per month for $2,500 coverage limit

That is money well-spent, especially when you consider the risks of working as a landscaper.

Why do landscapers need general liability landscaper insurance?

Most small business owners need general liability insurance because there’s always the chance of an accident or mishap on the job or incident otherwise related to your operations, that could result in third-party damage.

The risks are heightened for landscapers, who can face the following kinds of claims:

Non-employee third-party bodily injury – Third parties, such as a client or bystander. Should they incur an injury due to the work you’re rendering (for example, if a client trips over your toolbox and sprains their ankle), they could sue you.

Third-party property damage – Should you accidentally damage a client’s property, they could claim you are responsible. Say that you scratch a window while trimming weeds around it—general liability insurance would provide coverage.

Personal and advertising injury – Competitors could accuse you of libel or copyright infringement. With general liability insurance, your insurer would provide the investigation and legal defense of the claim as well as paying any settlements or judgments that you would otherwise have to pay.

General liability insurance is designed to provide protection from financial liability because of accidents that cause bodily injury, property damage, and personal and advertising injury to third parties. It also provides the investigation and legal defense for those types of claims brought against you and your business, even if you are ultimately not found to be responsible.

Why is landscaping equipment insurance worth the cost?

It might be easy to dismiss insurance for your gear as an unnecessary expense, but keep in mind that building up your tools and equipment was an upfront investment. Replacing a few small tools here and there is doable. However, you don’t want to pay out of pocket if one of your expensive lawn mowers breaks down or your tools are stolen from your truck.

The minimal cost of Business Equipment Protection, starting at $6 a month, is worth safeguarding the financial health of your business.

Not all equipment coverages are created equal. Most importantly, you want to look for the term “blanket coverage” in your policy to ensure that it includes all of your tools and equipment. With Business Equipment Protection, all the gear (under $2,500) you bring on the go is covered — but make sure that you purchase additional coverage for items over $2,500.

What impacts landscaper liability cost?

In addition to the types of coverage you need, your landscaping business’ unique risk profile plays a role in the cost of insurance. Your rate is typically calculated on the following factors:

Location – Dense urban areas tend to see more claims, which can affect your local business’s insurance premium.

Crew size – If you hire a crew, it increases the risk because there are more people performing work. Therefore, there are more chances that an accident or mishap with a client or third party while on the job could occur. You may also need to purchase workers’ compensation insurance.

Coverage limits – Your policy limit is the maximum amount your insurer will pay out for lawsuits and claims. The more coverage you need, the higher your premium will be. Thimble lets you select between $1 million and $2 million in coverage limits (but double the coverage doesn’t mean double the cost). For your landscaping tools and gear, choose between two coverage limits: $1,000 or $2,500, both with a $500 deductible.

Coverage term – As a landscaper, annual policies aren’t the only option. If you’re just starting out and are still building out your client list, you may only want to pay for insurance when you’re providing landscaping services. With Thimble, buy on-demand landscaping insurance by the hour, day, or week. That way, you’re only paying for insurance coverage when you’re working.

What other types of insurance do landscapers need?

Although general liability coverage is the most important type of business insurance for landscapers, there are additional coverages to consider. They should be factored in as additional business expenses (if applicable to your business).

Auto liability insurance – You need a truck or small van to carry your equipment and haul away clippings. If your landscaping company owns your vehicle, you will almost always need commercial auto liability insurance. However, if you’re using your personal vehicle to drive to and from jobs and work alone your personal auto insurance should be sufficient. The key with insurance is: Don’t assume. Work with your auto insurance provider to ensure you’re covered and no surprise expenses sideline your landscaping business due to inadequate auto insurance.

Workers’ compensation insurance – In most states, if you have employees, you’re legally required to buy workers’ compensation coverage. This type of insurance protects your business from the financial ramifications of an employee experiencing a workplace injury or illness on the job.

Commercial property insurance – Business Equipment Protection covers your equipment when it’s on the go. However, if you rent an office space, store your equipment in a commercial space or even your own garage, you likely need commercial property insurance. This type of coverage is used to protect your place of business and any property onsite. Coverage is typically priced based on:

- The building cost and size

- The risks inherent to that geographic location, such as environmental risk

- The age and type of equipment stored

- The age and type of building

Grow your business with insurance

As a landscaper you know watering and pruning helps gardens blossom. The same approach goes for your business. Protect and grow your landscaping business with the appropriate insurance coverage:

- Buy general liability insurance for landscapers, which generally ranges between $8 per hour and $43 per month.

- Protect your own property with Business Equipment Protection.

- Cover your vehicle with auto liability insurance (and find out if you need commercial auto insurance).

- Buy additional insurance, especially workers’ comp, if you have any employees.

It’s easy to protect your landscaping business with Thimble. After all, it takes less than 60 seconds. Click “Get a Quote” or download the Thimble mobile app, answer a few questions, and click to purchase. Your policy and Certificate of insurance will be in your inbox immediately and ready for your next job. Let our green thimble help you focus on your green thumb.