Whether you’ve got one dog or ten at the end of your leash, anything can happen when animals are involved—no matter how well-behaved they may be. When “sit,” “stay,” and “come back” don’t work, you’ll be glad you have dog walking insurance to cover any claims or damages.

But how much does dog walking business insurance cost? And what factors influence the cost? We’ll share the types of insurance for dog walkers and their price ranges in this guide.

How much does dog walking insurance cost?

Your job is to help exercise pups of all sizes and temperaments. When you’re working, you’re responsible for the dogs and everything they do. That’s why every dog walker needs general liability insurance.

Your dog walking business profit depends on how many dogs you can safely walk and how often clients book your services. You don’t necessarily need constant, ongoing coverage, especially during lulls in your usual work schedule. Thankfully, you have more options than the traditional, annual insurance coverage. With Thimble’s on-demand Dog Walking Insurance, you can purchase insurance by the hour, day, week, or month.

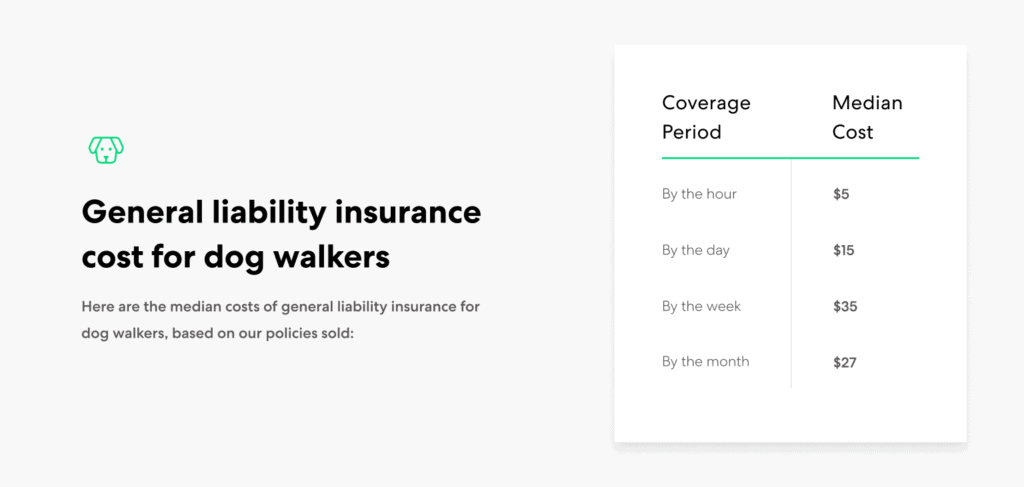

General liability insurance cost for dog walkers – Here are the median costs of general liability insurance for dog walkers, based on our policies sold:

- $5 per hour

- $15 per day

- $35 per week

- $27 per month

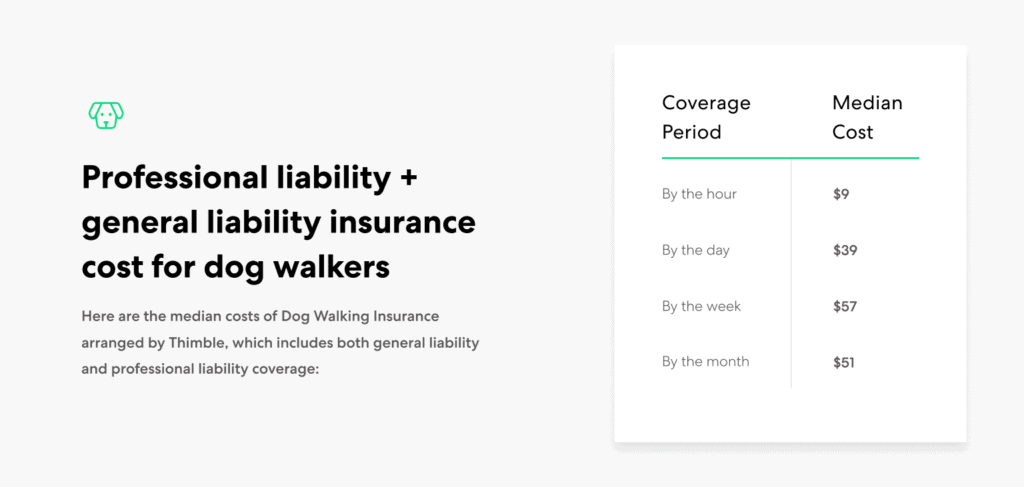

Professional liability + general liability insurance cost for dog walkers – Here are the median costs of Dog Walking Insurance arranged by Thimble, which includes both general liability and professional liability coverage:

Professional liability + general liability insurance cost for dog walkers – Here are the median costs of Dog Walking Insurance arranged by Thimble, which includes both general liability and professional liability coverage:

- $9 per hour

- $39 per day

- $57 per week

- $51 per month

Now that you know how much you should budget insurance, you may be wondering if this expense is really necessary? Next, we’ll dig into how dog walking insurance can benefit your business.

Why do dog walkers need general liability & professional insurance?

You may be able to hold your own against a pack of unruly pups, but that doesn’t mean they won’t cause you a problem or… a few.

General liability insurance is designed for accidents that cause third-party bodily injury, property damage, and personal and advertising injury. General liability insurance for dog walkers provides for the investigation, defense, and settlement for these types of claims brought against you and your business for the following situations.

- Third-party bodily injury – Includes accidental harm to human non-employee third parties, like customers and passing pedestrians. It also doesn’t apply to your employees; for that, you may need workers’ compensation.

- Third-party property damage – Whether it’s your pooch’s own home or somewhere along your regular route, accidental damage to someone else’s property may be covered. Notably, however, it does not apply to animal injuries under your care unless this option is offered by your insurer.

- Personal & advertising injury – Against claims that you made damaging public statements or posts against a competitor.

Professional liability insurance protects your business if your advice results in a financial loss for the client. As a dog walker, there’s a chance you might venture out into related pet care fields such as training or grooming. If you start providing professional guidance about proper animal care, there’s a chance you could be on the hook if your advice has negative financial repercussions.

Dog walking insurance can help keep your business as safe as you keep the animals in your care.

What affects dog walking liability insurance cost?

In addition to what type of coverage you choose, your premium can vary a bit depending on:

- Your location – If you work in a more populated area, where you might be more likely to encounter potential hazards.

- Your coverage limits – With Thimble, you can choose between $1 million and $2 million in liability coverage.

- The size of your team – (other humans, not your canine companions)

- The duration of your coverage – On-demand coverage gives you more flexibility, but the length of time for which you need the insurance impacts your overall cost.

These factors help determine just how much risk is involved with your dog walking business. You can think of it as the difference between a miniature daschund and a great Dane—one’s a lot more bark than bite.

Other types of insurance for dog walkers

Understandably, you care more about poodles than policy details, daschunds than deductibles, and corgis than coverage limits. But there are a few other types of insurance that can help your dog walking business as it grows.

Auto liability insurance – If your dog walking business owns the vehicle, you almost always need commercial auto insurance. However, if you only use your small car to drive to and from jobs, your personal auto insurance should be sufficient. We always recommend talking with your auto insurance provider to ensure you have the correct coverage.

Workers’ compensation – If you hire any employees to help walk your small but mighty army of well-trained dogs, you’re legally required to hold workers’ compensation insurance in case of workplace illnesses and injuries.

Keep those tails wagging with the right protection

When you arrive at a client’s home to take their pup for a walk, you can feel confident knowing you’re the best part of that dog’s day. But just because they’re excited to see you doesn’t mean they’ll be on their best behavior. Animals may be unpredictable, but insurance coverage doesn’t have to be.

- General liability insurance for dog walkers ranges from $5 to $27.

- As a bundle, general and professional liability coverage ranges from $9 to $51.

- You can buy additional insurance coverage as your business grows.

With Thimble, you can get full coverage faster than your client’s dog can fetch (in seconds). And because of our on-demand options, you only pay for what you need. Like a good boy, Thimble’s Pet Business Insurance comes when you call and follows your lead.

Take the lead and click “Get a Quote” or download the Thimble app. Answer a few brief questions, get your free quote, and click to purchase. With that, your policy and Certificate of Insurance (COI) will be instantly sent to your inbox.