As a pet sitter, you care for people’s beloved furry, scaled, and feathered friends when they’re not able to be there. Because your clients love their pets so much, there’s a chance their claws will come out if something goes wrong on your watch, and you could face a lawsuit. That’s why you should purchase pet sitting insurance in advance of your next appointment.

But how much does pet sitting insurance cost? In this short guide, we’ll go over essential coverage types for pet sitters and their price ranges.

How much does pet sitting insurance cost?

When you’re on the clock, you’re responsible for pets and any havoc they happen to wreak (whether towards a neighbor or their yard). For this, general liability insurance is the most important type of business insurance you need.

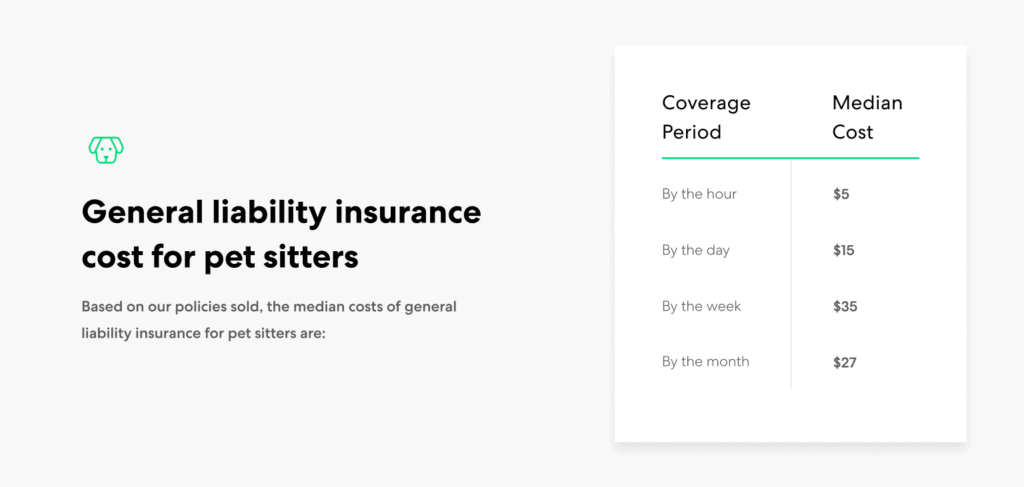

Usually, general liability coverage is purchased annually with a monthly premium payment. However, we know that pet sitters are often at the mercy of their clients’ schedules. You may not need round-the-clock coverage. That’s why we created on-demand Pet Sitting Insurance by the hour, day, week, or month. The costs below are based on data from Thimble’s policies sold.

General liability insurance cost for pet sitters – Based on our policies sold, the median costs of general liability insurance for pet sitters are:

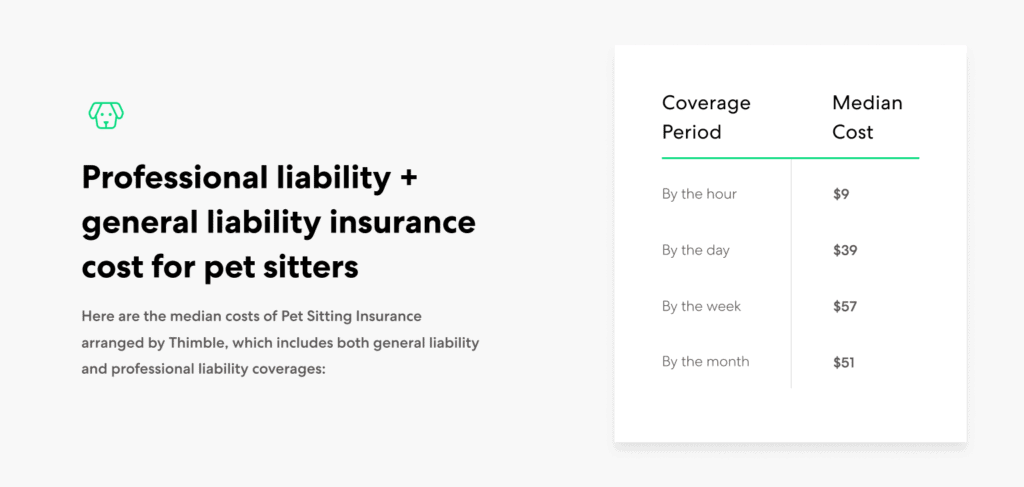

We also recommend that pet sitters purchase professional liability insurance. It helps cover a client’s financial losses as a result of you providing the wrong advice or failing to provide professional services properly. Together, professional liability and general liability insurance equal more fulsome protection for your business. That’s why most pet sitters choose to bundle them together.

Professional liability + general liability insurance cost for pet sitters – Here are the median costs of Pet Sitting Insurance arranged by Thimble, which includes both general liability and professional liability coverages:

Why do pet sitters need general liability & professional liability insurance?

You see seasonal ebbs and flow in your work as clients travel out of town. Thus, it’s reasonable to wonder if you actually need an insurance policy. The reality is that a single claim could require costly legal defense that totals more than your hard-earned income from several gigs. Here’s how general liability and professional liability coverages can safeguard your business.

General liability insurance is designed for work-related accidents that cause non-employee, third-party bodily injury and third-party property damage. It can also cover personal and advertising injury to third parties, such as a competitor. Here are two quick examples in which general liability insurance could protect you:

- Pet sitting often involves interaction with other animals. If the pet you are sitting gets into a tussle with someone’s else’s “precious fur baby” because you accidentally lost control of your client’s pet, the coverage could pay for the vet bills.

- You make sure your charges get plenty of exercise. Should someone trip over your client’s dog’s leash and break their ankle at the park, the injured party could sue you to pay for their medical expenses.

- Thimble’s pet sitting insurance also includes coverage for loss or injury to the pet in your care – something that is excluded under many standard general liability policies.

Professional liability insurance provides coverage if your professional advice resulted in a financial loss for the client. This might sound a little excessive; after all, clients hire you to watch their pets, not train them. However, as a pet sitter, clients see you as an expert and are likely to follow your professional recommendations.

What affects pet sitting liability insurance cost?

Beyond the types of insurance coverage you choose, the following factors can affect your coverage cost:

Location – If your area is more densely populated or its residents tend to be more litigious, there’s a higher risk of claims. This is reflected in your rate.

Crew size – If you and your full-time employee are both out on the job, there’s double the risk of incidents that could result in claims.

Coverage limits – The higher coverage limit could cover twice as much in legal costs and settlements, but it is slightly more expensive. With Thimble, you can choose between $1 million and $2 million in coverage. According to Thimble data, 94% of pet sitters choose the $1 million coverage limit.

What other types of insurance should pet sitters consider?

As you can see, it’s relatively affordable to get the pet business insurance you need. (And definitely more affordable than a lawsuit.) While you’re at it, look into other kinds of coverage that can help your business grow and thrive.

Business Equipment Protection – Also known as inland marine insurance, this type of coverage protects any gear or equipment that travels with you to and from jobs. As pet sitting equipment (leashes, crates, dog toys, etc) is relatively inexpensive, you most likely don’t need it. However, if all of these items were lost at one time, or if you’ve invested in any premium gear, this type of coverage might be worthwhile. Thimble’s monthly Business Equipment Protection, insurance for equipment you own and use for work, starts at $6 per month for a $1,000 coverage limit.

Auto liability insurance – Chances are you that use your personal car or small truck to drive to and from pet sitting jobs. Auto insurance is required to drive a car, and there’s a chance your personal auto insurance provides enough coverage. However, if your business owns the vehicle, or if you drive a customized commercial vehicle outfitted so that you also can offer mobile grooming, then you’ll almost always need commercial auto liability insurance. Before using your vehicle for work, you should always talk with your auto policy provider to ensure you’ve got the appropriate coverage.

Workers’ compensation insurance – It’s always exciting when you’re ready to hire your first employee! When you do, keep in mind that most states require employers to provide workers’ compensation insurance for their employees. This insurance can help provide coverage for employee injury, illness, or disability sustained on the job.

Insurance: A pet sitter’s best friend

Dogs may be human’s best friend, but as a pet sitter, yours is insurance! Before you let Fido off-leash, remember these insurance cost tips:

- General liability insurance for pet sitters ranges from $5 to $27.

- As a bundle, general liability and professional liability coverages range from $9 to $51.

- You can buy additional insurance coverage as your business grows.

Once you have insurance, you’ll be able to fully enjoy your pet sitting job. If you’re ready to get insured, just click “Get a Quote” or download the Thimble mobile app, breeze through a few questions about your business, and we’ll generate an instant quote. Within seconds, your pet sitting business can have the coverage it needs, along with your policy and Certificate(s) of Insurance.

And that’s how we make “fetch” happen.