Woodworking and construction are inherently risky. With the equipment, heavy machinery, or hazardous job sites, injuries and accidents happen. This is why most carpenters choose to purchase carpenters insurance. But how much does carpenters insurance cost? And what factors dictate the price? Let’s go to boarding school.

How much does carpenters insurance cost?

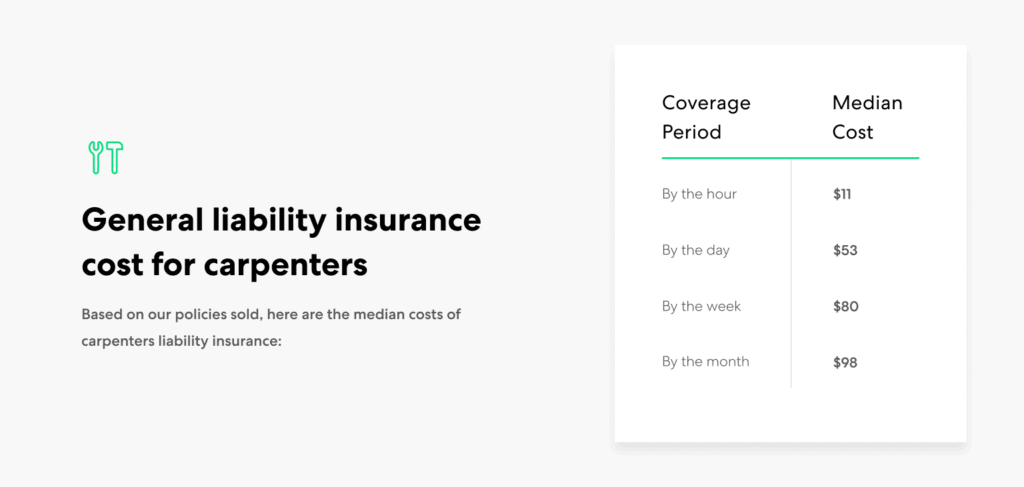

Due to the high risks associated with carpentry, general liability insurance is the most important type of coverage for carpenters. As higher-risk professionals working with tools and dangers around job sites, carpenters can also expect higher insurance costs (compared to less risky occupations such as cleaners). Typically, carpenters have only had the option of annual coverage with a monthly premium. However, Thimble’s Carpenters Insurance is flexible with coverage options by the hour, day, week, or month. Based on our policies sold, here are the median costs of carpenters liability insurance:

- $11 per hour

- $53 per day

- $80 per week

- $98 per month

Additionally, carpenters usually purchase equipment insurance to protect their tools. While general liability insurance protects other people’s property, equipment insurance protects your stuff. We call this coverage Business Equipment Protection. It covers the tools and equipment that travel with you. Here are the median costs of carpenter equipment insurance, based on monthly Thimble coverage:

Additionally, carpenters usually purchase equipment insurance to protect their tools. While general liability insurance protects other people’s property, equipment insurance protects your stuff. We call this coverage Business Equipment Protection. It covers the tools and equipment that travel with you. Here are the median costs of carpenter equipment insurance, based on monthly Thimble coverage:

- $6 per month for a $1,000 coverage limit

- $15 per month for a $2,500 coverage limit

Now that you know how much carpenters insurance costs, let’s dive into why you need liability insurance.

Why do carpenters need general liability insurance?

Practically every single carpenter needs general liability coverage. Why? Because carpenters interact with third parties constantly, including clients. General liability insurance provides coverage for the investigation, defense, and settlement for third-party claims relating to these kinds of situations:

- Third-party property damage – While delivering a custom piece, you accidentally damage the client’s property.

- Non-employee, third-party bodily injury – Non-employee, third-party bodily injury

- Personal and advertising injury – Third parties, like competitors, could sue you for libel or copyright infringement if, for, example, your new table design resembles a competitor’s design.

General liability insurance is a no-brainer for carpenters. It safeguards your business from the risks that come with interacting with third parties. Let’s look at the coverage you need to protect your first-party property.

Why do carpenters need equipment insurance?

What’s a tradesman or tradeswoman without tools? Your equipment is costly, and you rely on these tools to perform your craft. To protect your investment in your tools and equipment, you need inland marine insurance, or what we simply call Business Equipment Protection. This coverage can help cover the cost of damage to your equipment (under $2,500) that travels with you to job sites. It can help pay to repair or replace tools and equipment that are lost, stolen, or damaged by accident. Not every equipment insurance coverage is the same. Typically, inland marine insurance only covers the tools explicitly listed in your policy. Updating your policy with new tools creates more work for you and takes away from the time you could spend woodworking. That’s why Business Equipment Protection is blanket coverage. This means any tools under $2,500 that travel with you are covered.No line-itemized list needed!

What impacts how much carpenters insurance costs?

The exact cost of your carpentry insurance can vary based on a few factors, including:

- Location – Your business location can impact the cost as the number of people in your area can contribute to your overall risk profile. More people lead to more opportunities for an accident or bodily injury to occur. Your premium often reflects this increased risk.

- Crew size– Whether it’s just you at work, or if you have employees factors into your insurance cost. More employees mean greater risks of an accident occurring, especially to a third party, which leads to higher premium costs.

- Coverage limits – How much coverage you need will impact the cost of premiums. Higher limits provide greater protection at an increased cost. Carpentry Insurance via Thimble comes with a $1 million or $2 million liability coverage limit. And for equipment coverage, we provide two coverage limits of $1,000 or $2,500, both with a $500 deductible.

- Coverage length – How long you need coverage for significantly impacts your insurance cost. With Thimble, you have more flexibility than ever before, with coverage for as short as an hour. Choose between coverage by the hour, day, week, or month.

What other types of insurance should carpenters consider?

In addition to general liability coverage and equipment insurance, many carpenters choose to purchase other types of coverage. These include:

- Auto liability insurance – As a carpenter, you likely use a small van or pick-up truck to travel to job sites and deliver finished products. Auto liability insurance can be a little tricky, so it’s always best to confirm your coverage needs with your auto policy provider. As a general rule, if your business is listed as the vehicle owner, you almost always need separate commercial auto liability insurance.

- Workers’ compensation – Every state except Texas requires businesses with employees to have workers’ compensation coverage. If one of your employees gets sick on the job or injures themselves while working, workers’ comp could help shield your business from liability and cover the associated costs. Always check state requirements to confirm what you need to do to comply with their worker’s comp laws.

- Commercial property – Do you own or lease a woodshop? If that’s the case, commercial property insurance can help protect the building and the things you keep in it (equipment and inventory). The cost varies, depending on the building’s size and type, surrounding area, and equipment value within the building.

Get into the (right) groove with insurance

Woodworking is a valuable skill. But the job isn’t easy, nor is it risk-free. Knowing this, you must purchase the right insurance coverage to protect your business from risk. Keep in mind:

- On-demand carpenters insurance ranges from $11 an hour to $98 a month. Business Equipment Protection covers your tools you take to job sites for$6 per month.

- You may need commercial property insurance to protect your shop and the equipment inside.

- Consider additional types of coverage based on your handyman business needs.

With Thimble, it’s fast and easy to get the affordable, on-demand insurance coverage you need. To purchase your custom policy in under 60 seconds, simply click “Get a Quote” or download the Thimble mobile app and answer a few quick questions. After receiving your free quote, click to purchase, and we will instantly send your policy and any necessary Certificates of Insurance (COI) to your inbox.