Small Business in a New World

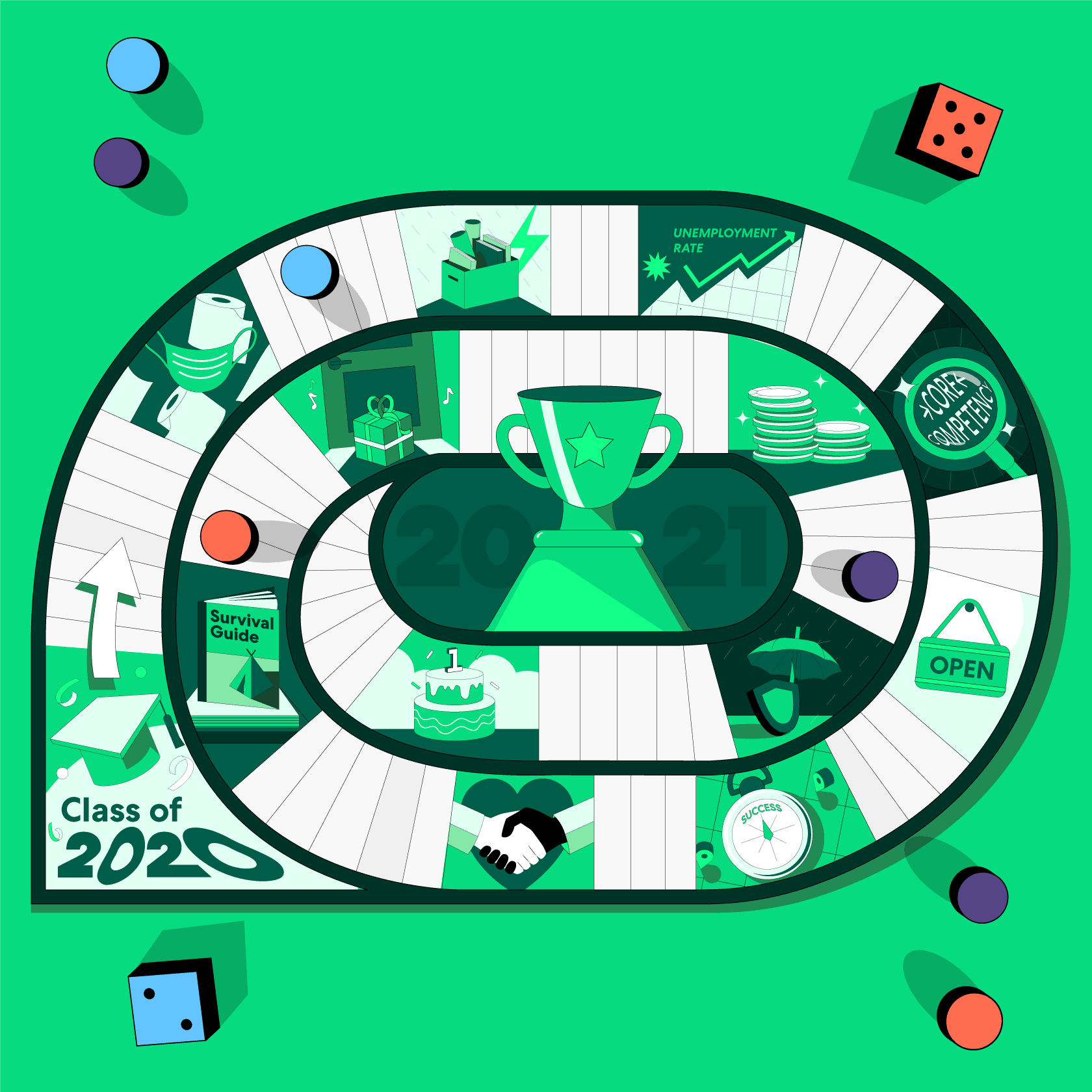

Wake up and smell the hand sanitizer – it’s a new day for small business in America. Greenlight by Thimble is all about keeping our finger on the pulse of Main Street, and last quarter, we profiled some of the most inspiring stories of small business pivots during the pandemic. Now, we’ve asked over 50,000 entrepreneurs to tell us how they’re recovering, and it’s clear that these are the cards you’ve got to play right: your attitude, your health, and your money. We’re breaking down all three, because they all add up to how ready you are to meet your opportunity.

Welcome to The Comeback, a chronicle of how businesses like yours are working their way back to 100%. Packed with interviews with Thimble customers and opportunities to answer the hard-hitting questions throughout! Take polls while you read to see how your answers compare to other entrepreneurs in real time.

We’ll break down the results when we talk all about your attitude, but it’s clear that doers like you are on their way back — because the only thing “down for the count” is the number of airborne particles. Let’s go.

“Being an entrepreneur can be tough. This last year more than ever before, you’ve had to wake up fighting every day.”

Kellenne Vann, Thimble Customer and Owner of Cleaning with Meaning

Your Attitude

Your attitude about your business is the first factor that will get you out of bed in the morning and keep you trying, trying again. It’s the secret sauce for businesses that have endured some of the worst hardships in America throughout history, and that tenacity is reflected in our Greenlight Optimism Index.

Our first big question: what do you think your comeback will look like?

What do you think your business recovery and success will look like as COVID restrictions lift in your state?

- 1

- 2

- 3

- 4

- 5

Business won’t recoverBusiness as usualBetter than ever!VoteWhat’s your email?

Enter your email to see the survey results and get our 5-minute newsletter, Greenlight by Thimble, every two weeks.

NextWhat do you do?

Tell us what kind of small business you are so we can serve you the most relevant, up-to-date news.

NextWhat year did you start your business?

Greenlight by Thimble is fun for all ages.

Submit and view resultsWhat do you think your business recovery and success will look like as COVID restrictions lift in your state?

Business won’t recoverBetter than ever!

Nearly a third of small business owners expect their business to perform even better than before the pandemic! But across different industries, the nature of the work has produced some interesting insights. Housecleaners, for example, indicated that, on the whole, they don’t expect to see major changes in demand, because so many people will still be working from home. On the other end of the spectrum, less-optimistic businesses are concerned with a lack of capital to ramp up necessary budgets like summer advertising.

Construction pros and contractors, however, are looking forward to people being more comfortable having workers in their homes, as well as increased client opportunities as the average family’s financial situation improves. Large-scale consumer trends tell us that people are spending more on their homes and home improvement than ever before, so a lot of residential service professions are ripe with opportunity for anyone willing to put in the work. The most important work, though, is maintaining a healthy, balanced life.

Your Health

When we look at what it means for a business to make a comeback after COVID-19, we would be remiss if we didn’t highlight the topic that’s become more important than ever: your health.

What precautions are you taking as you get back to work?

- Enforcing your own mask mandate

- Low/no contact service

- Sanitation requirements

- Occupancy or group number restrictions

- Other

VoteShow me the results-

It’s a big question, and many of our customers like landscapers, handymen, and cleaners have been hard at work throughout the pandemic. But for large group business settings like storefronts, pop-ups, and farmer’s markets, a comeback will mean even more safety precautions; 100% of respondents so far said they’ll implement at least one new health or safety measure in their comeback from this pandemic.

But amidst all the excitement to return to full restaurants. live events, and entertainment, some people are clearly taking a more level-headed approach. One survey respondent put this perspective best: “We don’t need to make this a party. We re-open and pay attention to how people engage. We only want an organic flow of people.’

These are inspiring insights, because we know small business owners will outthink. outwork, and out-Lysol anything that life throws their way. But what’s the latest on CDC guidelines?

As of May 2021, the Centers for Disease Control (CDC) says fully vaccinated people can gather indoors without wearing a mask or staying six feet apart, gather in most outdoor venues, and even travel internationally again. The CDC has also released specific guidance for businesses and employers about the virus, but as all of that post-pandemic freedom might suggest, anyone who wants to do business in truly “post-pandemic” world should want to get vaccinated. And even so, those health precautions we mentioned earlier are even more responsible ways to safely re-open.

For the most up-to-date, local information, check out your state’s official COVID guidelines.

In the wake of so much isolation and loss, we know now that we just can’t take anything for granted. Put simply, preserving your physical and mental health is the first step to preserving the longevity of your business; one can’t exist without the other. Despite any conventional wisdom that pushes you to the limits of human “hustle,” you can’t build a business on burnout. You need a solid foundation, and from there, you can start collecting more important resources.

“There were a lot of hoops to jump through for those [SBA] loans that didn’t make them seem like they’d really be worth it.”

Bryan Kimbell, Thimble Customer and Chief Strategist at Ethike Marketing

Your Money

With our physical and mental health in mind, let’s check the other major vital for a solvent small business: financial health. Your money! Everybody wants it—most of us don’t have enough of it. It’s a stressful topic for many, because a lot of that taboo comes from the idea that your money equals your worth. But at Greenlight, we believe that true success is about doing what you can with what you have, and the events of the past year have brought lots of new financial resources to small businesses.

“My main thought right now is “Can I tweak my cost structure?” I’m trying to figure to out if I can reduce my day rate or travel costs in order to get the assets created, so can take advantage of the licensing opportunities. I’m creating a menu so I can get my pricing to match different price levels.”

Matthew McNulty, Thimble Customer and Architecture Photographer

People like Matthew are finding innovative ways to widen their customer base. They said you’ve got to spend money to make money, and in the case of COVID-19, you’ve maybe been asked to spend more than you ever expected to comply with contactless pickups, digital sales and shipping, the rising costs of construction materials, or building those yurts in the street. Those expenses, along with the losses many businesses have sustained as business slowed, led the Small Business Administration to administer billions of dollars in relief aid, but getting that hasn’t exactly been… straightforward.

What’s the latest on the Paycheck Protection Program (PPP)?

At the time of publishing, the Small Business Administration (SBA) has stopped accepting new applications for PPP loans except for those from community development financial institutions. Roughly $8 billion was set aside to support to low-income and underrepresented groups who haven’t had access to traditional banks. Over the past year, the SBA has given out the better part of a trillion dollars in largely forgivable loans to small businesses, but nearly everyone has had a different experience with getting the help they need.

Architecture photographer Matthew McNulty was able to get a loan. He told us, “I got the PPP but I had to wait til they opened up to the freelance side. I would say that the coolest thing about the last year is that freelancers have been fully recognized now… and I used Womply to get the loan.”

Independent marketing consultant Bryan Kimbell offered a different perspective: “There were a lot of hoops to jump through for those [SBA] loans that didn’t make them seem like they’d really be worth it. And for me to do it as a loan, even if it was forgivable loan, I didn’t think that the benefits would outweigh the effort of even applying. Reserve those funds for the organizations like restaurants out there that really need it to stay afloat.”

Beyond the SBA, many other organizations and private sector companies have stepped up to offer aid to smaller businesses, and those alternatives have also been an effective means of staying afloat for some. But however you got relief aid, there are plenty of ways to invest in your business, both in helping it grow and protecting your assets, so here’s the natural next question: how are you spending it?

As business rebounds, what are you most likely to spend more money on?

- New tools or equipment

- Hiring and personnel costs

- A bigger insurance policy

- Marketing and advertising

- Other

Show me the results-

So far, roughly 22% of respondents have indicated that they would like to reinvest in hiring and in spending on their existing employees, in order to come back stronger than ever. About 20% of small business owners indicated that they’ll be targeting different groups of customers. For some, this as straightforward as being able to work in-person once again. For others, the pandemic taught them something new about their customer base, and they want to diversify and expand on the people they serve. The takeaway: think about how you can re-engage with your market. Do you customers know that you’re coming back? Are there new clients emerging in your industry as the economy stabilizes?

Several respondents to our original survey also indicated that they were sensitive to the fact that their customers may be hesitant to spend money or have less disposable income than they once did-after all, COVID-19 took a toll on our economy as a whole. As a result, some are offering special reopening promotions for their most loyal, repeat customers or marketing through their social media to allow those clients to claim a discount.

“My reputation is really what I focus on: my attention to detail and building a reputation for doing high quality, thorough work.” Kellenne Vann, Thimble Customer and Owner of Cleaning with Meaning

Kellenne understands an important lesson of building a business: relationships may serve you better, and for longer, than any business loan; a one-time injection of cash can only take you so far, but investing in building a great team or becoming a fixture in your community could sustain a career. And for more and more people who got in the game over the past year, this is your career. You’re in it for the long haul, and all this preparedness will have you ready to meet your opportunity.

“If you have a cancellation, you’ve got to make sure there’s enough buffer time for you to replace that client. As a solopreneur, it’s very hard to do the work and get the work at the same time. You can plan all you can, but it’s always great to have a contingency plan in place.” Bryan Kimbell, Thimble Customer and Freelance Marketing Consultant.

Stacking the Deck in Your Favor

We’re on the cusp of a real return to normalcy in America, but at this point, “business as usual” probably sounds as funny to you as “clear PPP guidelines.” You might still be thinking, Will the loans be forgiven?, Will the plastic shields stay up forever?, and most importantly, Do I really have what takes to bounce back? We’re here to say you do.

The Comeback has been all about aligning your health, your money, and your attitude to set yourself up for success, however you define it.

How are you making your comeback? What are you investing in, how are you adapting, and how are you staying motivated? Let us know in the comments below!

In conclusion, pick your chin up, keep your eyes on the prize, and get your hands dirty (then washed, obviously). And share Greenlight by Thimble with another small business owner who needs some pep in their step! We’re rooting for you, and building the best products to serve you, every step of the way.

Definitely spending a lot of money and time re-engaging with my customers and making it known I’m about to be in-person again.

This is great! Interesting to see how performance outlooks vary according to one’s industry/profession.