As a DJ, you know how to get the party started and keep people on their feet all night. But for every good dance party, you run the risk of a trainwreck, in the physical sense of the word. And if clients try to blame you for any ensuing property damage or third-party injuries, it’ll be anything but good vibes.

Luckily, DJ insurance can protect you from liability claims. But how much does DJ insurance cost? And what factors go into the pricing? This guide breaks it down.

How much does DJ insurance cost?

A good track has highs and lows. Same with insurance prices. The cost of DJ insurance can vary based on the type of insurance you need, coverage limits and duration, and where your business is located.

Whether you’re playing a small party or entertaining in Vegas, you’ll want to protect yourself with three essential types of insurance coverage:

- General liability insurance

- Professional liability insurance

- DJ equipment insurance

Next, we’ll break down the average costs of each type of insurance for DJs.

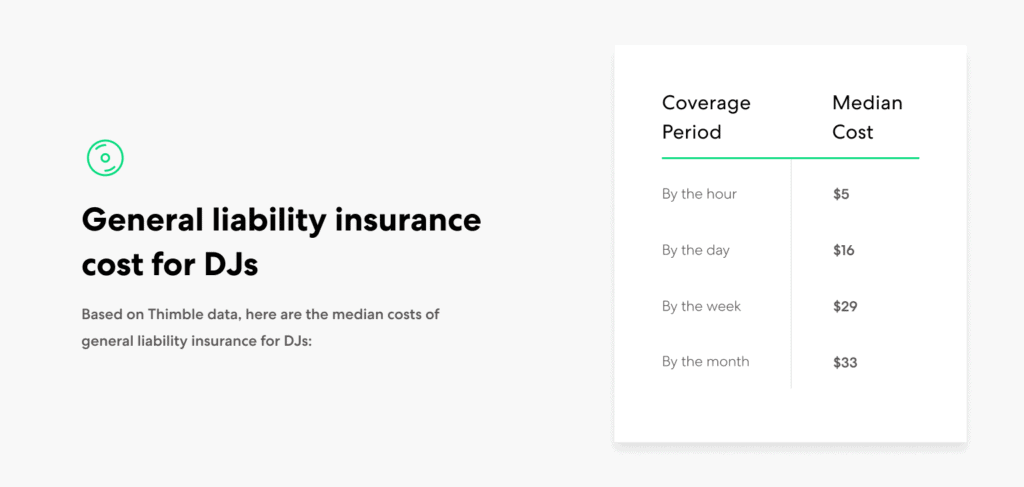

General liability insurance cost for DJs – Based on Thimble data, here are the median costs of general liability insurance for DJs:

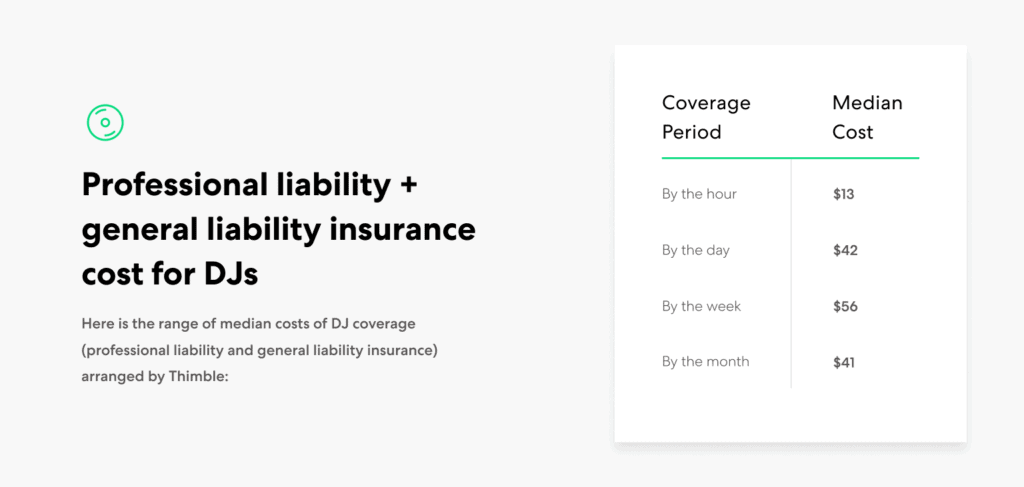

Professional liability + general liability insurance cost for DJs – Together, general and professional liability insurance create a perfect harmony to protect your DJ business. One without the other leaves your business exposed to potentially costly risks. That’s why many DJs opt to bundle them together. Here is the range of median costs of DJ coverage (professional liability and general liability insurance) arranged by Thimble:

DJ equipment insurance cost – Do you own or rent valuable DJ equipment that you bring on the job around potential hazards and liabilities? Business Equipment Protection covers your DJ equipment and gear you take to and from gigs.

Based on our data of monthly Business Equipment Protection plans, the median monthly cost is:

- $6 per month for a $1,000 coverage limit

- $15 per month for a $2,500 coverage limit

Why do DJs need liability insurance?

General liability insurance is the bare minimum for any business owner who regularly interacts with third parties, including clients and other vendors. It provides protection from the financial repercussions of third-party claims in situations like these:

- Non-employee third-party bodily injury for patrons, guest artists, and clients alike. (Employee injuries while on the job are not covered by general liability insurance.)

- Third-party property damage that occurs in arenas, clubs, private homes, banquet halls, and any other public or private venue you might play.

- Personal and advertising injury against claims that you publicized something damaging to someone else’s reputation.

General liability coverage is sometimes bundled with professional liability insurance for DJs.

Professional liability insurance is the second essential type of DJ insurance. Professional liability insurance covers any errors and omissions that resulted in a financial loss for the client as a result of professional advice or services you provided.

As a professional, you open yourself up to risk when you provide advice or recommendations to clients based on your expertise. For example, a client may consult with you to confirm if a venue has the necessary amperage to host a DJ, and you gave them the go-ahead. However, on the day of the event, your sound system causes the venue to lose power and the event has to be rescheduled, or even worse, cancelled, meaning lost revenue to the venue. If a client claims that your professional mistake resulted in their financial loss, you could be held liable.

How to choose DJ equipment insurance

Also known as inland marine insurance, this type of coverage is a no-brainer for DJs because it can provide payment for the cost of damages if your equipment is lost or stolen. However, equipment insurance can have some tricky nuances, so make sure to read the exclusions.

When choosing DJ equipment insurance coverage, look closely at the following:

Coverage limits – DJ equipment can be expensive, so make sure your coverage limits would cover the cost to replace your gear.

Deductible – How much you pay before your insurance kicks in. Usually, the higher the deductible, the lower your monthly cost as you’re willing to take on more of the cost thus reducing the risk to the insurance provider. As with all types of insurance, make sure this is a reasonable number, and not something you’ll never reach.

Type of coverage – Look for blanket coverage in your policy; otherwise, only the equipment listed in your policy is covered. As a busy DJ and business owner, you don’t have time to update your policy every time you purchase or upgrade your gear. That’s why Business Equipment Protection arranged by Thimble gives you blanket coverage on all your DJ gear wherever you go (if it’s under $2,500 in value).

What factors affect DJ insurance cost?

There are a few other variables that will affect the cost of your DJ insurance including:

Location – The area in which you do business can impact the cost. Urban areas are more densely populated which increase the risk of an accident. This increased risk is usually reflected in your insurance premium.

Crew size – Are you a one-person crew, or do you have a team working with you? Depending on how big your crew size is, your policy might be affected. You’ll pay higher rates to insure each member of your band if it’s small.

Coverage limit – The more coverage you need, the higher your insurance cost. At Thimble, choose between a $1 million or $2 million limit. Opting for the higher option will be slightly more expensive, but it will provide more coverage.

When it comes to protecting your DJ equipment, choose between two coverage limits of $1,000 or $2,500 both with a $500 deductible. If that’s not enough to cover all of your gear, Thimble also offers an optional added protection for up to two individual $2,500 items.

Coverage duration – Record scratch. Hold up. DJing can be a sporadic gig. What if you don’t need annual insurance coverage? Especially when you’re just starting out, you don’t want to pay for insurance when you’re not working. At Thimble, we offer on-demand coverage for that exact reason. You can purchase DJ insurance to cover an hour-long gig, a full-day event, or a week of back-to-back performances.

What are other types of DJ insurance?

Now that we’ve laid the foundation, it may be time to layer in some more complex beats and rhythms—by that, we mean additional types of insurance. They won’t affect your DJ liability insurance costs, but are important to consider in terms of your businesses expenses.

Commercial property insurance – Most DJs take their show on the road, but if you lease a private studio or office, chances are you need additional property insurance. While Business Equipment Protection covers the DJ equipment that travels with you, commercial property insurance covers any equipment in your studio or office as well as the building premises. The exact cost depends on the specifics of your property, including the location and its environmental risk, the property age and size, as well as the equipment stored inside.

Workers’ compensation – Maybe you’re more than just a DJ. Maybe you’re a record-spinning, beat-pumping, music-loving entrepreneur to boot. If you have employees, you’ll likely need workers’ compensation coverage for your assistants, roadies, and other staff. (In fact, workers’ compensation is legally required in most states.

Auto liability insurance – If you have a dedicated company vehicle that’s owned by your business, you’ll likely need separate commercial auto liability coverage. With that being said, if you’re just driving to and from venues, you might very well be covered by your standard personal auto policy (meaning no additional expenses). Safeguard your business by confirming what type of coverage you need with your auto insurance provider.

Let the show go on with insurance

When you’re on mixing tracks, it feels like nothing can stand in your way. But even as a professional DJ, things can (and do) go wrong all the time. With the right insurance coverage, it can, regardless of the accidents and mishaps that may come your way. Securing insurance coverage is an important part of running a successful DJ business.

If you’re ready to safeguard your DJ venture, just click “Get a Quote” or download the Thimble app. From there, you can obtain a customized policy and Certificate of Insurance in seconds.

It takes less than a minute to focus on the beat drop for hours.