A Certificate of Insurance (COI) is a document that shows that a person (or business) is insured. It displays the kind of liability insurance you have, who issued it, the business name it’s under, how much money it will pay out should you be responsible to a third party, and more.

As you might imagine, that’s a lot of information to pack into a single page.

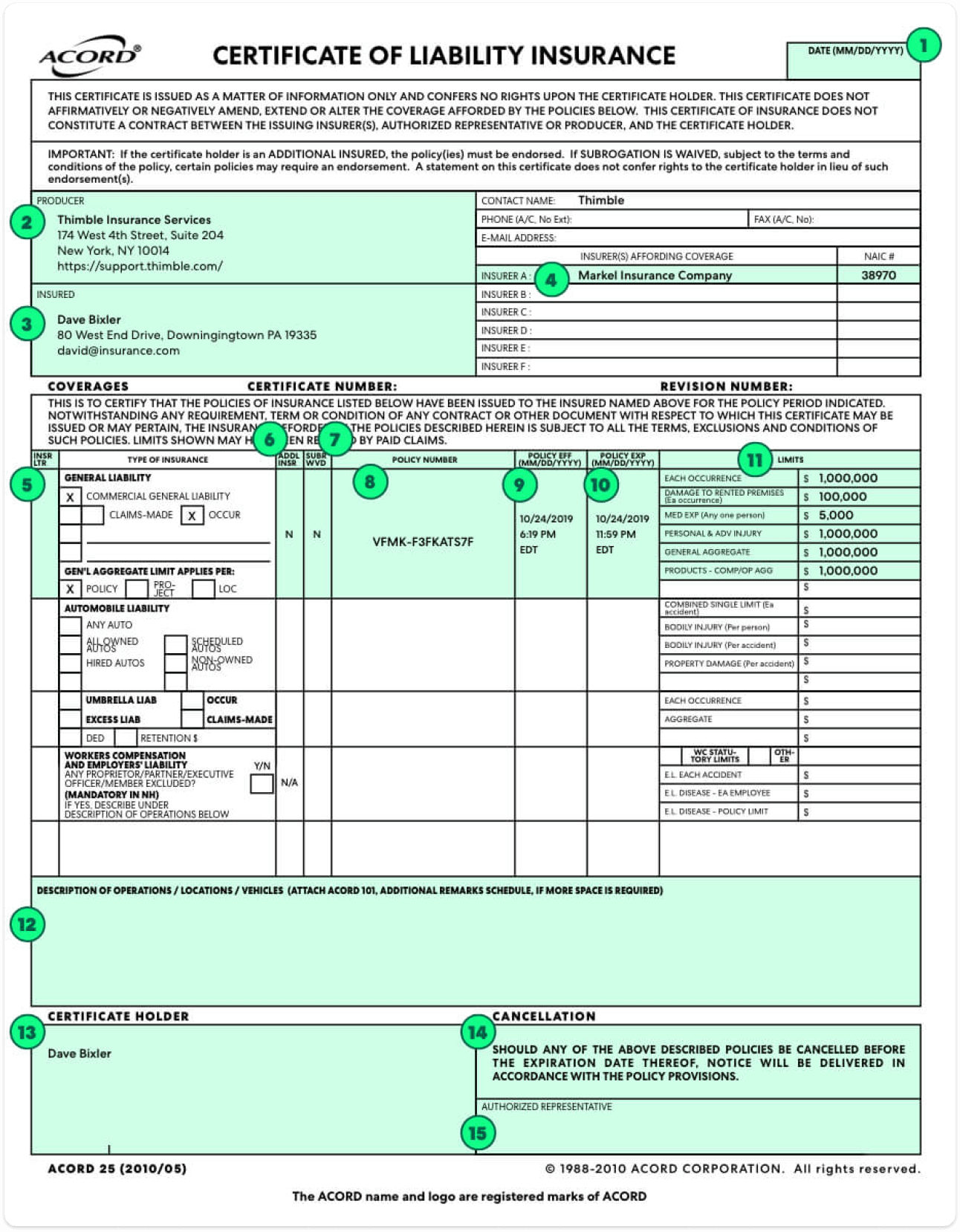

Most brokers and insurers use a COI form called an ACORD Certificate of Liability Insurance. However, even if the COI you’re looking at isn’t based on the ACORD template, it should list the following important information:

- The date of the policy effective and expiration dates

- The name of the certificate holder

- The name of the people or businesses who are covered by the policy

- The name of the insurance carrier

- The type of coverage it provides

- The limit of the insurance provided (in dollars)

Confused about what this jargon means, or why it’s important? Don’t worry. We’re going to break down everything you need to know. Let’s start with the top and make our way down, shall we?

Understanding a Certificate of Insurance

At the very top of the COI, you’ll see the ACORD logo and a message explaining that what you are looking at is a Certificate of Insurance. This will state something official, like:

“THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER.”

This statement will be in all caps to ensure there is no confusion that this document is merely a COI showing proof of insurance, and does not amend or change any terms of the referenced insurance policy.

Beneath that will be the date of the COI and the interested parties it involves:

1. Date: This refers simply to the date the certificate was issued. It is not the same as the Policy Effective Date, which notes the date that your policy goes into effect.

2. Producer: This refers to the agent of record who represents the insurers or the insured in the transaction. It will include the legal name of the broker or the agent, along with their business address.

3. Insured: This refers to the policyholder (that’s you!). It will include the legal name of the policyholder, whether that’s your name or the name of your company. As with the Producer, this will include contact information associated with your policy, such as your business address and email or phone number.

4. Insurer(s) Affording Coverage: This section will name all the insurance companies providing coverage, along with their NAIC number. Think of this as the insurance company that will ultimately pay out the claim should you have one. This number is assigned to each individual underwriting company registered with the National Association of Insurance Commissioners (NAIC). If there is only one insurer, their name will appear in the first line, next to the words “Insurer A.” If there is a second insurer, their name and NAIC # will appear in the second line, next to the words “Insurer B.” If you guessed the third insurer is listed as “Insurer C,” you’ve got the hang of things.

Now, onto the Coverages section. This is the main section of the COI. It is organized into different rows, with each row representing a different type of insurance coverage. These may include:

- General Liability

- Professional Liability

- Hired and Non-Owned Auto (HNOA) Liability

- Umbrella and Excess Liability

- Workers Compensation and

- Employers’ Liability

Always make sure that your coverage is appropriate for the activities you’ll be doing. For example, a stunt person likely needs a different type of liability insurance than a freelancer. The types of coverage often boil down to the types of risk inherent to the profession.

For each type of insurance coverage, the following information will be listed in columns, creating that tabular format you see on COIs:

5. Insr Ltr: This stands for “Insurer’s Letter” and refers to which insurance company is providing this specific coverage type. If you see an A in this column, it refers to the insurer identified as Insurer A in the Insurers Affording Coverage section.

6. Addl Insd: This stands for “Additional Insured.” This will indicate whether the Certificate Holder is listed as an Additional Insured on the referenced policy. In layman’s terms, this states whether or not your client, or whoever you are sharing the COI with, is named as an Additional Insured. If so, this column will be marked with a Y or X to represent “yes”. If not, the column will remain blank or be marked with a N or N/A to indicate “no.”

7. Subr Wvd: This indicates whether or not the right of subrogation (SUBR) has been waived (WVD) for Additional Insureds. If so, there will be a Y or X in this column to indicate “yes.”

8. Policy Number: This one’s easy: it’s the policy number, and it uniquely represents a single policy. With Thimble, you can easily check your policy status by entering this number.

9. Policy Effective Date: This is the date the insurance policy becomes effective. It needs to be before, or coincide with, the effective date of your business contract.

10. Policy Expiration Date: This is the date the insurance policy expires, which needs to be on or after the termination of the business contract.

To fully protect your business, you want to make sure that your coverage:

- Began before you started the project

- Will continue past the end of your contract

If your coverage doesn’t span the entire period of your contract, you could be on the hook financially, should anything negative occur. Need an example?

Let’s say you’re a hairstylist employed to create futuristic looks for the cast of your short sci-fi film. You had a valid policy that started before filming began, but reshoots have caused the original shooting schedule to be extended. During that time, your coverage lapsed.

Should you accidentally burn your star’s head while styling her hair, you could be made to pay the cost of any medical bills the star has as a result of this hair disaster. (So for your wallet’s sake, check those dates.)

11. Limits: This section describes the individual policy limits for each type of coverage listed. For example, the general liability line will include the limit for each occurrence, third-party bodily injury, medical expenses per person, property damage, and personal and advertising injury. It also provides for the investigation, defense, and settlement for these claims, even if the claims are determined to be false, frivolous or fraudulent!

Important note: All policies include limitations and exclusions. A COI does not display all terms and conditions of the policy; it merely provides evidence that coverage is in force. To determine the full scope of coverage, you may need to ask for a copy of the policy, or talk to the producer.

12. Description of Operations / Locations / Vehicles: This section will outline any specific operations, locations, or vehicles this COI refers to.

Finally, we reach the end of the document. This section reveals who the Certificate Holder is and seals the COI with a signature from your insurer.

13. Certificate Holder: The COI shows to a third party that the named insured has insurance. The third party is requesting such evidence so the third party will be listed as the certificate holder. In this case, because you are requesting the certificate, you would be the certificate holder.

14. Cancellation: Bookending the COI is an additional statement of official text, which essentially states that the insurer will notify the Certificate Holder if your policy is canceled for any reason before the Policy Expiration Date listed. This only applies if the client is listed as an Additional Insured.

15. Authorized Representative: This will feature a signature from an authorized representative who issued the COI. This is usually the producer who is able to provide such information.

How do you get a COI?

If you’re looking for a flexible, affordable, and on-demand business insurance provider, then you’re in the right place. At Thimble, our insurance works when you do. You can tailor a policy to the hour, day, week, month, or year that you need insurance coverage.

And when it comes to COIs, you can generate as many as you want—completely free. Just click “Get a Quote” or download the Thimble app, breeze through a few quick questions, make your purchase, and you’ll have a Certificate of Insurance sent directly to your email inbox. In under a minute, you can go from having no proof of your insurance to being able to show others you have the coverage on hand for whatever life throws your way. Crisis averted.

Reminder: The certificate cannot amend the coverage As noted at the top of the COI page,

THIS CERTIFICATE IS ISSUED AS A MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW.

As such, it is important that if you have requested any modifications to the policy, such as being added as an Additional Insured, that you request a policy endorsement and get a copy of that endorsement.

Recap: How to read a Certificate of Insurance & protect your business

As a small business owner, the last thing you need is any unforeseen financial losses due to a lack or lapse in liability coverage.

Once you have your COI, double-check it to make sure that reflects the actual coverage you have on your policies. This includes showing that your coverage:

- Starts and ends on the right date

- Legitimately insures your business

- Provides the type of coverage that’s needed

- Has a sizable liability limit

You should expect a COI from others with whom you work, and if you’re performing services for your client, they’ll also probably expect a COI from you.

Additionally, a Certificate of Insurance can help you earn your clients’ trust, and secure more projects for your business.