Celebrating the hard-earned end of a career is not without risk. Anytime you bring a group of people together, you have to be prepared for all the “what-if” accidents that can happen.

Furthermore, most retirement celebrations will have their fair share of alcohol, increasing the risk that someone will get hurt, something will get broken, or a playful roast will go too far. Retirement Party Insurance helps to prevent you, as the party host, from having to pay out of your retirement savings for these types of incidents.

What is Retirement Party Insurance?

Retirement Party Insurance is a type of special event insurance that provides financial protection against third-party claims resulting from injury or property damage.

While you think you can trust those in your inner circle not to go after the money, if someone suffers a bodily injury or their property is damaged, they may seek monetary help to cover the costs. A guest, vendor, or venue owner could bring a suit against you for:

- A slip-and-fall accident leading to bodily injury

- Damage to a guest’s personal property

- Damage to the rented premises.

Retirement Party Insurance protects the retirement party planner from the financial repercussions of these types of incidents.

What does Retirement Party Insurance cover?

A retirement party can be thrown by family, friends, or coworkers who want to congratulate and honor the retiree’s career. While this doesn’t seem like a risky affair, you can’t count out fate (or even false claims); and Retirement Party Insurance provides the investigation services and a legal defense of claims. Legal defense will even be provided if someone exaggerates a claim or makes a completely fraudulent claim against you.

Retirement Party Insurance can provide financial protection to you for claims made by guests, bystanders, vendors, or venue owners for incidents such as:

- Third-party bodily injury (non-employee): If a guest grabs a chair, not realizing someone else was about to sit down on it and another guest falls as a result, you could be held liable for the bodily injury the guest incurs.

- Third-party property damage: When giving a colleague a hug, the retiree’s hand catches on their necklace and breaks it. While it may not seem fair, you could be held liable for the damage.

- Personal and advertising injury: A lot can be said in good jest during a retirement roast, but you may find yourself in hot water for libel or slander if a guest believes that their reputation has been tarnished.

- Damages or injury from liquor liability: Alcohol is often part of celebrating. If you allow alcohol to be consumed at the event and someone is overserved leading to damage or harm, you could be liable. If you are in the business of selling, servicing or furnishing alcohol at the event, you may need to purchase additional liquor liability coverage.

How much does Retirement Party Insurance cost?

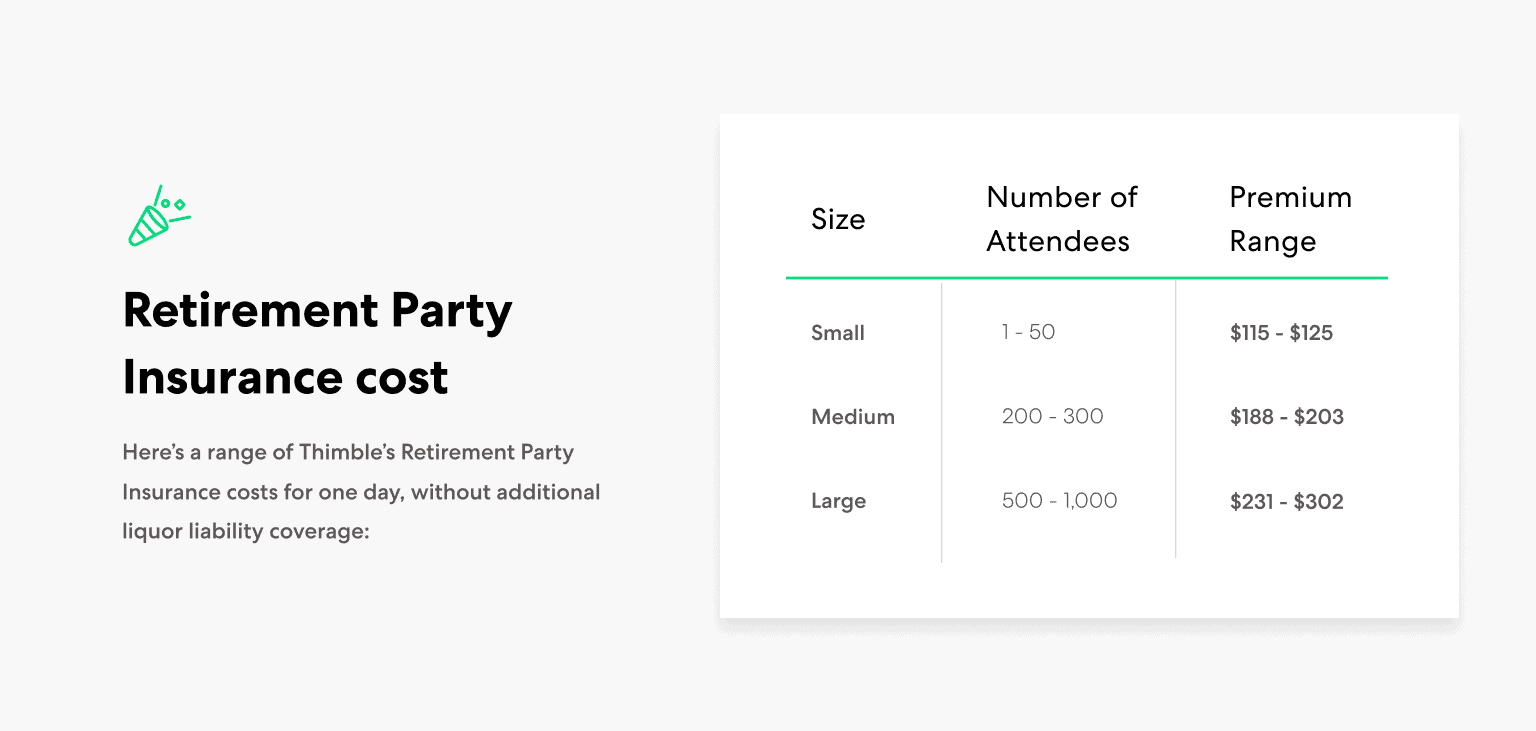

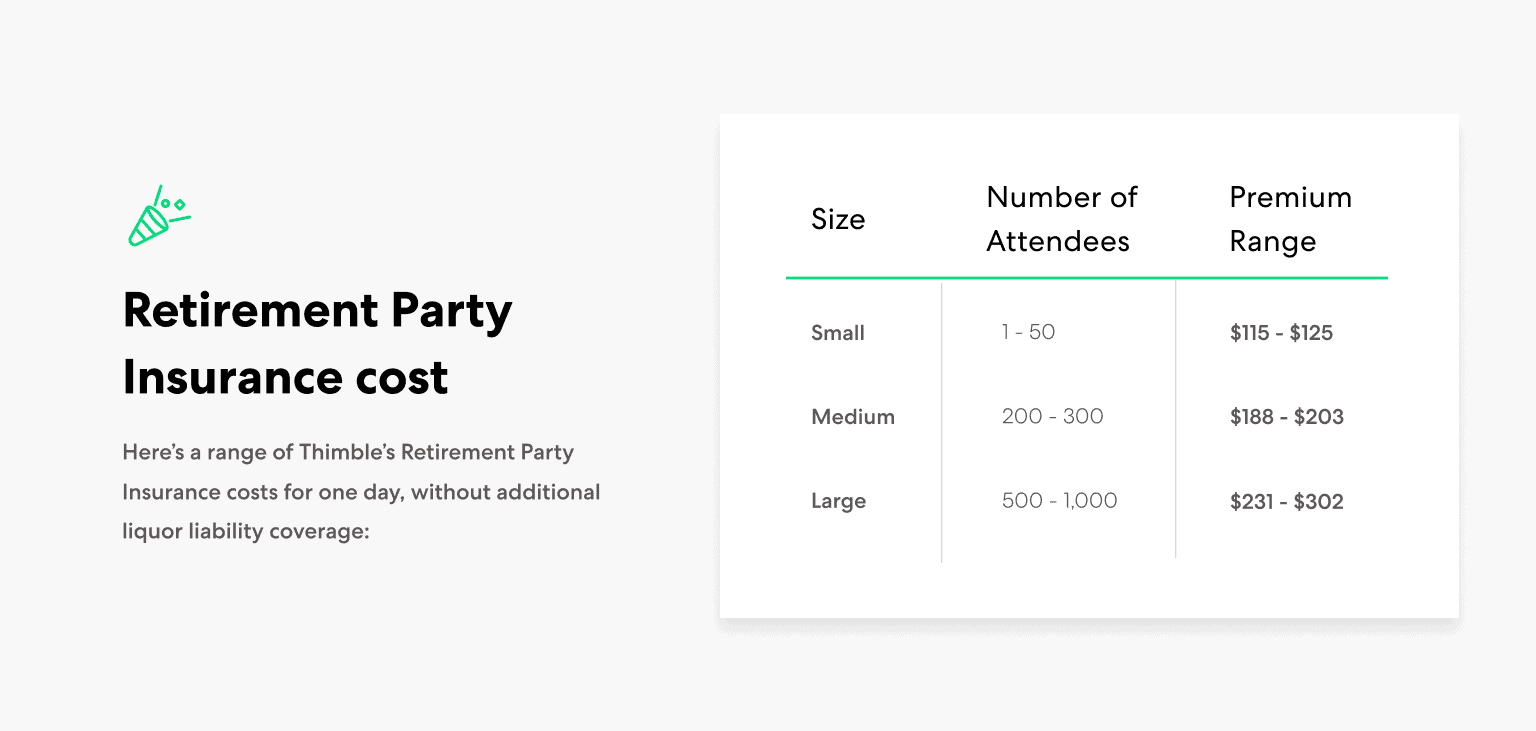

A retirement party is usually a one-day event, and Thimble’s Retirement Party Insurance can cover parties with anywhere from 1 to 1,000 people. The premium you pay will depend on the size and duration of the party. If you have any risky activities at the party, that will also increase the premium (but be sure to check what activities are excluded).

Here’s a range of Thimble’s Retirement Party Insurance costs for one day, without additional liquor liability coverage:

Who needs Retirement Party Insurance?

If you’re planning a retirement party, you need Retirement Party Insurance. It doesn’t matter if you are an individual or an organization — the organizer bears the risk and thus needs the protection.

When you book the venue, the venue owners will most likely ask you to provide a Certificate of Insurance (COI). This is proof that you have a liability policy and lists your coverages, provides your policy details and shows that your policy is in effect during the retirement party. It should also name the venue as an Additional Insured if they require it, which extends coverage to the venue owners. Most venues will require general liability coverage to have at least a $1 million per occurrence limit with a $1 million aggregate limit.

Thimble makes getting your policy and COI a piece of cake. And you can get it within seconds, which is faster than you can bake a retirement cake. It doesn’t get any easier than that.

Retire with ease

A retirement party should be a celebration of a legacy that isn’t marred by having to pay for a costly claim. Even though incidents can lead to financial losses, Retirement Party Insurance can protect you from the financial consequences of claims. This way you can focus on remembering your toast or speech rather than be concerned with having to pay up if something goes wrong.

Give us your email address if you’d like to be notified when Thimble’s Retirement Party Insurance is available in your area.