You’re not in the business of losing money, which is why you need to make sure that you get the right coverage for your next business event. While the goal of the event you are organizing is to get qualified prospects to your door, a gathering of people can increase the risk of someone getting hurt or having their property damaged and bringing a claim against you.

Business Event Insurance is a type of special event insurance that protects you from the financial consequences of third-party claims of injury or property damage. The cost of a claim can be very bad for business, so check out what’s covered.

What kinds of claims does Business Event Insurance cover?

Your business event could include a seminar or product demonstration, but accidents don’t discriminate the purpose of your event. A slip-and-fall accident can happen to anyone, anytime, and you need the right coverage in place before it occurs.

One of the key components of Business Event Insurance is that it provides investigation services and legal defense for claims. This can safeguard you if someone brings an exaggerated claim against you, and can help identify fraudulent claims, so you only pay a fair settlement if needed.

Here are the main coverages you can expect from your Business Event Insurance:

- Third-party, non-employee bodily injury: An attendee trips over your pop-up banner stand, falls and gets injured. You could be sued and held responsible for his medical expenses.

- Third-party property damage: Your employee bumps someone while he’s trying to get a picture of your business demonstration. The attendee drops his phone and breaks it. You could be deemed responsible for the damages and have to pay the cost of repair.

- Personal and advertising injury: A competitor accuses you of copyright infringement in your marketing materials for the event; you could be held liable for advertising injury.

- Damages or injury from liquor liability: If you allow alcohol consumption at your event (for example during the networking mixer) and someone who was drinking gets hurt or causes damage, you could be held liable.

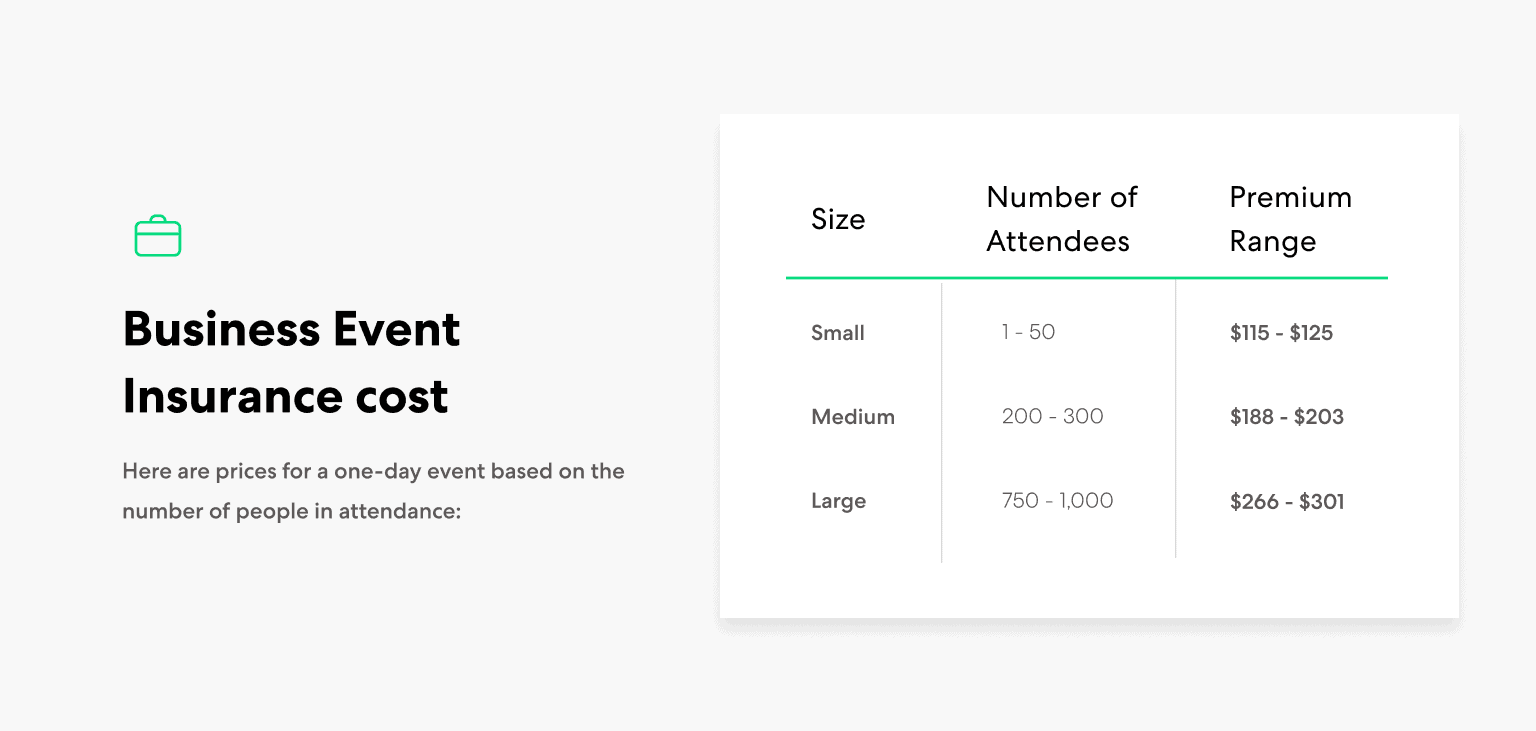

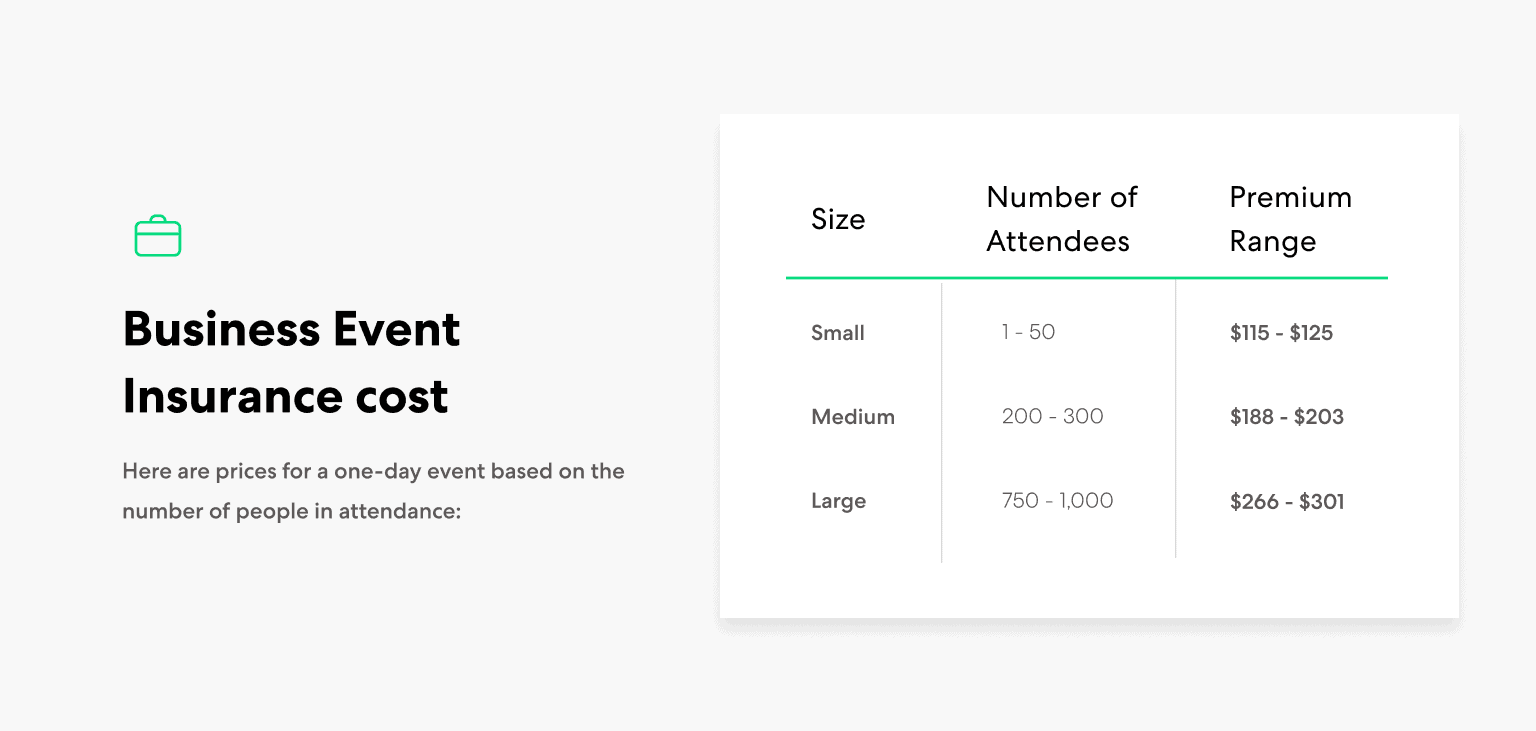

How much does Business Event Insurance cost?

Budgeting for your business event is an important aspect of making sure it is a success. Don’t forget to budget for the Business Event Insurance. While costs will vary depending on how large and lengthy the event is, you can expect the cost to be much less than you’d end up paying as a result of a claim.

Here are prices for a one-day event based on the number of people in attendance:

Who needs Business Event Insurance?

As the organizer of the event, you likely need Business Event Insurance. After all, you could be held liable for the injury if a volunteer steps forward to share commentary, slips and takes a spill onstage. Or if the caterer’s beverage dispenser breaks and spills piping-hot coffee on someone, you could be in for an eye-opening liability claim.

Furthermore, the owners of the venue where you hold the event will likely ask you for proof of insurance, which is demonstrated by a Certificate of Insurance (COI) from your insurance carrier). Not only will they want a COI that lists your coverages under the event insurance policy, but they may want to be Additional Insureds on your policy. With Thimble, you can get as many copies of your COI as you need, and add as many Additional Insureds as you need on your policy — all at no extra cost.

Seal the deal with Business Event Insurance

You should make sure to get insured before your event and get coverage for the set-up, breakdown, and duration of the event. With Thimble’s Business Event Insurance, you can:

- Get liability coverage for your event that covers injury and property damage to third parties.

- Get coverage and obtain a COI in under a minute, and add as many Additional Insureds as you need at no additional cost.

- Get covered for damages and injury due to liquor liability.

Get your policy today (almost) as fast as you can exchange business cards.