As a certified personal trainer, you help people achieve their health and fitness goals. Whether it’s slimming down, bulking up, or preparing for their next big race, you’re spotting your clients.

While you use your specialized training to reduce the likelihood of injuries for your clients, there’s always the risk that something could go wrong. Personal trainer insurance safeguards your business against the financial risks of working with third parties. But how much can you expect to pay for personal trainer insurance? And what factors into the cost?

This guide explains it all.

How much does personal trainer insurance cost?

The primary variable in the total cost of fitness instructor insurance is what type (or types) of coverage your business needs. There are three main categories of business insurance for personal trainers:

- General liability insurance

- Professional liability insurance

- First-party equipment insurance

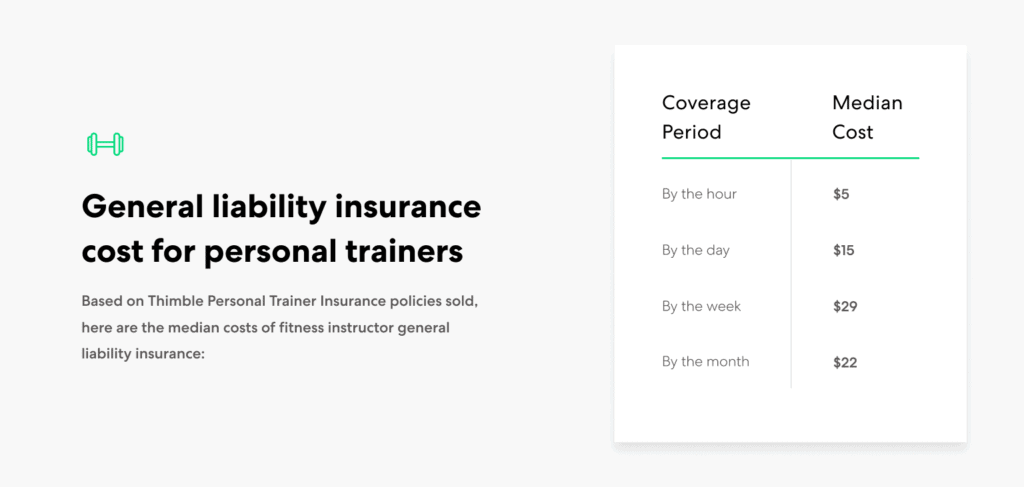

General liability insurance cost for personal trainers – Based on Thimble Personal Trainer Insurance policies sold, here are the median costs of fitness instructor general liability insurance:

- $5 per hour

- $15 per day

- $29 per week

- $22 per month

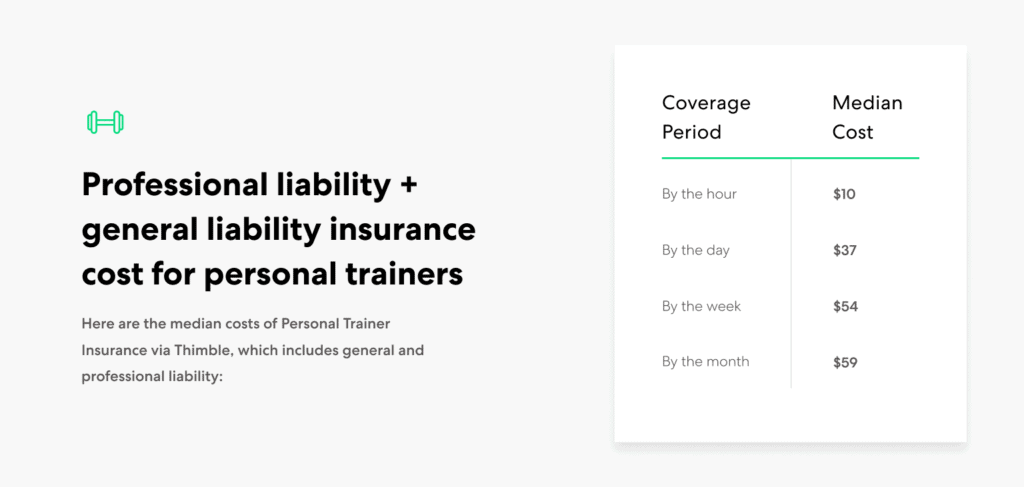

Professional liability insurance + general liability insurance cost for personal trainers – Combined with general liability insurance, professional liability insurance protects your fitness business from third-party claims, including errors and omissions related to your professional advice and services. Together, they reduce the amount and types of risks your business is exposed to. Here are the median costs of Personal Trainer Insurance via Thimble, which includes general and professional liability:

- $10 per hour

- $37 per day

- $54 per week

- $59 per month

Equipment insurance cost – As a trainer, you’ve invested in sets of weights, kettlebells, TRX bands, and various fitness equipment to sculpt and tone clients. To protect the gear you take with you to train clients, you need a type of equipment coverage called Business Equipment Protection (BEP). Here are the median monthly costs of our Business Equipment Plans:

- $6 per month for $1,000 coverage limit

- $15 per month for $2,500 coverage limit

Why do personal trainers need general liability?

As a personal trainer, you interact with third parties every day. For this reason alone, general liability insurance is the essential backbone of high-performance coverage. It can provide coverage and legal defense for claims like these:

Third-party bodily injury – If a client trips over a weight and breaks an anklet during a training session with you, they could sue you for bodily injury. Keep in mind that general liability insurance protects your business against costs resulting from non-employee bodily injury. If your employee is injured during work, your workers’ compensation coverage kicks in (see more on this below).

Third-party property damage – If you drop a weight on a client’s stray cell phone or damage the floor while training at their house, they could sue you for property damage.

Personal and advertising injury – You could also face claims of libel or copyright infringement against a competitor.

Why do personal trainers need professional liability?

You regularly give your clients professional advice. If your services or advice led your client to lose money or miss out on a financial opportunity, they could claim that you were liable. For instance, a client misses a major speaking event because an exercise they did during a training session caused a back spasm, so they sue you. And even if they don’t have a great case, legal defense is expensive!

In these circumstances, professional liability insurance provides investigation and defense for claims and pays damages where a client claims your advice led to their financial loss.

At Thimble, we bundle general liability insurance and professional liability insurance for personal trainers to provide all-around coverage. After all, you want to focus on training clients and growing your business, not managing multiple insurance coverages.

Why is equipment insurance worth the cost for personal trainers?

Insurance for the equipment you use to help train clients is considered first-party property coverage; neither general liability insurance nor professional liability insurance covers it.

It’s essential to review the coverage details when purchasing equipment insurance. Depending on your needs, look for the following language:

- Accidental loss or damage and loss-of-use of your equipment

- Lost and stolen equipment

- Accidental loss or damage to equipment temporarily in your possession (i.e., rented gear)

Also, make sure your policy provides blanket coverage, which insures all of your equipment wherever you take it. This matters because traditional equipment insurance, known as inland marine insurance, often only covers equipment specifically listed in your policy details (known as “scheduled property coverage”).

What factors impact how much personal trainer insurance costs?

What accounts for the range in numbers? The following factors influence your specific cost:

Location – If you operate your personal training business in an area where claims are more common, your insurance cost may be higher.

Crew size – If you work with an assistant, there’s a chance that their work could result in a claim, too. The more people you employ, the higher your premium will be.

Coverage limits – You can choose your own coverage limits (the maximum amount your insurer will pay for a claim). Higher coverage amounts come with a higher premium. At Thimble, we offer two liability coverage limits of $1 million and $2 million.

Coverage length – The amount of time you want to be insured will affect the policy’s price.

We recognize that not every personal trainer needs around-the-clock coverage. That’s why we’ve created on-demand insurance. If an annual insurance policy isn’t right for you, choose coverage by the hour, day, or month. After all, why pay for insurance when you’re not working? Hey, even trainers need a rest day.

Other types of insurance for personal trainers

Beyond the three essential kinds of coverage that we’ve outlined above, you may also need the following types of policies:

Commercial property – While Business Equipment Protection protects the equipment that travels with you, commercial property insurance can provide coverage for your place of business and its premises. If you own or lease a studio or an office, you most likely need commercial property insurance. Cost is typically calculated by a few external factors that include, but are not limited to:

- Environmental risks (geographic location)

- Building and lot size

- The building’s age and type of construction

- Type of the equipment onsite

Business Owners Policy – Some small business owners find it helpful to bundle several types of insurance to cover their equipment and their liability together under one policy. A Business Owners Policy (BOP) typically includes general liability insurance and commercial property insurance.

Auto liability – Chances are you only use your vehicle to drive to and from training appointments. Unless your business is listed as the owner on the title, your personal auto policy will likely suffice. If this is the case, there’s no additional insurance cost you need to factor in! Always talk with your auto insurance provider to ensure you’ve adequately covered.

Workers’ compensation insurance – If you’ve hired any employees, you may be legally required to purchase workers’ compensation insurance to provide coverage for an injury, illness or disability they sustain on the job (depending on your state).

Keep your business in shape with insurance

As a personal trainer, you know that a healthy diet and exercise are the foundation for good health. As a small business owner, think of your insurance coverage as a health booster for your personal training business!

As a personal trainer, you know that a healthy diet and exercise are the foundation for good health. As a small business owner, think of your insurance coverage as a health booster for your personal training business!

- Personal trainer insurance coverage can range from $5 per hour to $22 per month.

- You may need Business Equipment Protection to cover the equipment you take to train clients.

- You may need other types of coverage, especially if you own or lease a studio or gym.

At Thimble, we’re all about personalized solutions, just like you! Choose from annual or on-demand fitness business insurance and select your policy limits to take control of your insurance costs.

If you’re ready to get your business in shape, click “Get a Quote” or download the Thimble mobile app to get started. It takes less than 60 seconds to answer a few questions about your business. Once you click purchase, we’ll send your policy and Certificate of Insurance to your inbox immediately.

Personal trainer insurance helps your business become a lean, mean fighting machine. (Hopefully not too mean!)