Whether you’re a freelance writer, designer, marketing or IT consultant, photographer, or a variety of other professions—you’re in charge. From finding clients to taking care of business issues, pretty much everything falls on your shoulders.

That includes any costs of claims, lawsuits, legal fees, and more. Regardless of your specific industry, there are accidents and mishaps waiting to happen. But as a solo operation, is the cost of freelance insurance even worth it?

The answer is yes—but let’s break down the numbers and what types of business insurance freelancers need.

How much does freelancer & consultant insurance cost?

As your business is dependent on working with third parties, every freelancer and consultant can benefit from general liability insurance and professional liability insurance. These two coverages will have the biggest impact on how much freelance insurance costs for you. Here are the costs.

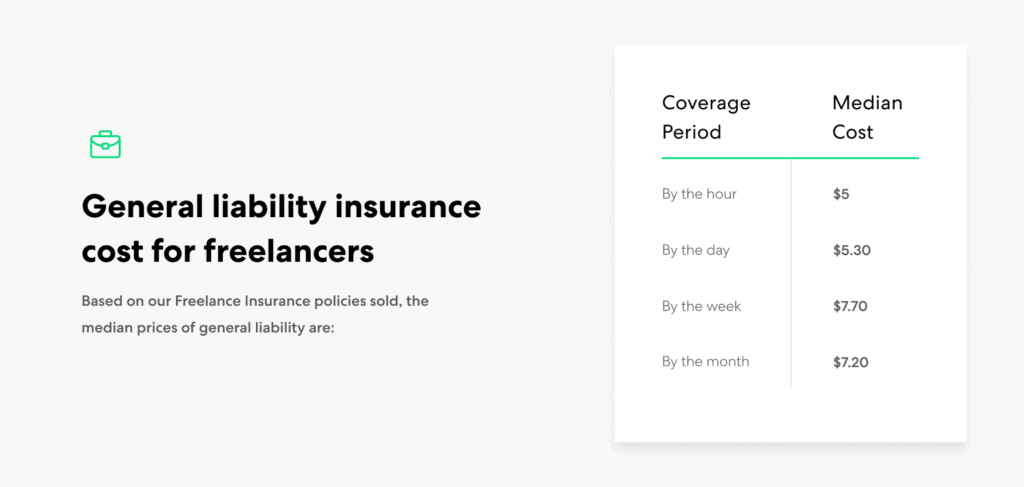

General liability insurance cost for freelancers – Based on our Freelance Insurance policies sold, the median prices of general liability are:

- $5 per hour

- $5.30 per day

- $7.70 per week

- $7.20 per month

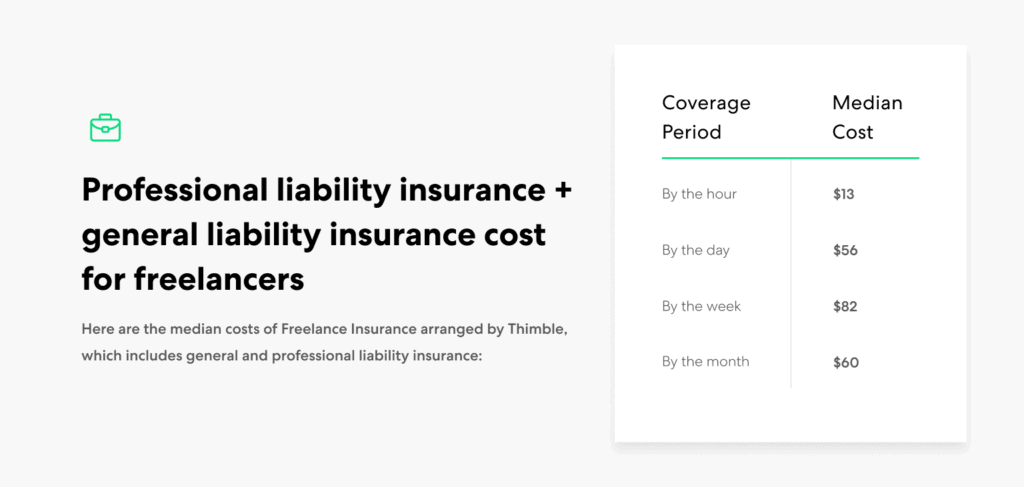

Professional liability + general liability insurance cost for freelancers – In addition to general liability insurance, consultants need professional liability. Clients turn to you for your professional advice and services, which exposes you to additional risk not covered by general liability insurance. As such, most freelancers choose to bundle both coverages together. Here are the median costs based on policies arranged by Thimble, which includes general liability insurance and professional liability insurance cost for consultants:

Professional liability + general liability insurance cost for freelancers – In addition to general liability insurance, consultants need professional liability. Clients turn to you for your professional advice and services, which exposes you to additional risk not covered by general liability insurance. As such, most freelancers choose to bundle both coverages together. Here are the median costs based on policies arranged by Thimble, which includes general liability insurance and professional liability insurance cost for consultants:

- $13 per hour

- $56 per day

- $82 per week

- $60 per month

Equipment insurance cost – Thimble’s Business Equipment Protection covers any equipment that travels with you to and from jobs. Based on our data, the median monthly cost is:

Equipment insurance cost – Thimble’s Business Equipment Protection covers any equipment that travels with you to and from jobs. Based on our data, the median monthly cost is:

- $6 per month for $1,000 coverage limit

- $15 per month for $2,500 coverage limit

Why do freelancers need liability insurance?

You are your own business, which means any lawsuits and liability fall to you. Those unexpected costs could completely sink your freelance business if you don’t take precautions to protect yourself. The two essential types of insurance to safeguard your business are general liability insurance and professional liability insurance.

General liability insurance – If you work face-to-face or interact with third parties, general liability insurance is an essential protection. General liability coverage protects you from the financial repercussions of non-employee, third-party claims stemming from bodily injury, property damage, and personal and advertising injury.

Professional liability insurance – General liability damages aren’t the only thing you need to worry about as a freelancer. Clients rely on you for your expert advice and professional services. However, this also exposes to you a number of risks.

Generally intended for white-collar professionals, professional liability insurance provides the investigation and defense for claims. It can pay damages where a client claims your advice, or failure to provide professional services properly, led to their financial loss.

To simplify things, Thimble bundles both professional liability coverage and general liability coverage together under freelancer insurance—it doesn’t make much sense to have one without the other.

Property insurance: Two main coverages for freelancers

Working for yourself often means buying (or renting) your own equipment, whether it’s an expensive laptop, videography setup, and more. If anything were to happen, there’d be no one to cover the charges of repairing or replacing your valuable equipment—without the right coverage.

If you regularly take equipment to job sites or third-party locations, you need inland marine insurance, which Thimble simply calls Business Equipment Protection. This type of coverage protects your equipment against:

- Accidental damage to or loss of your equipment or equipment that you’re renting or borrowing

- Lost and stolen property and tools

It’s important to note that Business Equipment Protection does not cover any equipment that stays in your office or studio (doesn’t go with you to job sites), such as a printer. Instead, commercial property insurance covers this equipment.

If you work from home, there’s a chance that your homeowner’s or renter’s insurance might not cover all your business property. Commercial property insurance can fill those gaps. The price depends on the specifics of the property, its geographical features, and more. If you have a home-based business, make sure to check with your home insurance provider to understand what is and isn’t covered.

Factors that influence how much consultant insurance costs

Depending on the coverages you choose, your premium will typically be calculated based on a few factors, including:

What do you do? Your exact field helps determine how much inherent risk is involved. In a riskier profession, you’re more likely to run into some kind of trouble, meaning you’re more likely to need your insurance coverage. For example, a freelance IT consultant is likely exposed to less physical risk than a freelance DJ.

Where do you work? The location of your business impacts your insurance cost, as businesses located in bustling metropolitan cities or densely packed areas are typically exposed to more risk.

How many people do you work with? As a freelancer, you’re likely working with an army of one, which should lower your rate. However, if you grow your business and hire team members, bigger teams mean more moving parts to keep track of (and greater assumed risk).

How long do you work and how long do you need coverage for? Naturally, longer coverage periods cost more.

How much coverage do you need? Costs depend on your own risk assessment and how much protection you want. The more coverage, the higher your premium.

At Thimble, you can opt for either $1 or $2 million limits for liability coverage. According to Thimble data, 84% of freelancers choose policies with $1 million liability limits.

Traditionally, business insurance is purchased annually with a monthly premium. If you’re thinking that “monthly freelance insurance” is an oxymoron (or, at the very least, unnecessarily expensive), you’re not alone.

You don’t always work for the whole month—your insurance shouldn’t either.

Thimble’s on-demand coverage is a more flexible option when you’re only working on a few projects during the month. Get coverage when you need it by the hour, day, week, or month.

Find freedom with freelancer insurance

As an independent contractor and entrepreneur, you have plenty on your plate at any one time. After all the work you’ve put into building your client base, solidifying your reputation, and creating high-quality deliverables, the last thing you want is to slow down because of some lousy lawsuit or claim. Remember that:

- Freelancers and consultants should purchase both general liability and professional liability insurance.

- Consultant liability insurance costs can range from $5 per hour to $60 per month.

- Consider Business Equipment Protection and commercial property insurance to protect any business equipment and your office space and the property in it.

By protecting yourself from potential incidents and errors, you can focus your energy into doing what you do best.

With Thimble, you don’t have to slow down to purchase business insurance. You can get covered in seconds. Click “Get a Quote” here or on the Thimble app, answer a few quick questions and purchase your policy. Instantly, your policy and Certificates of Insurance (COI) will be in your inbox and you’re ready to go.

You got into this line of work for freedom and independence, after all. Why stop now? And by reviewing the costs above, it’s a small price to pay for peace of mind!