Are you a cleaning business owner? Then other people’s messes are your business. Whether you’re erasing a party’s aftermath or keeping a corporate space squeaky-clean, you do every job with care.

But you put out that “Wet Floor” sign for a reason: your job has its risks.

Professional cleaners should invest in cleaning business insurance to cover job-related liability and give clients more confidence. In this short guide, we’ll go over the cost of cleaning business insurance and highlight the factors that influence your premiums. Let’s do this!

How much does cleaning business insurance cost?

As a cleaning business owner, you work close to client’s valuable possessions, from expensive electronics to antique objects. That means you’ll need general liability insurance to protect against damages to this third-party property.

Cleaning business insurance costs vary based on a few factors, including your business risk profile, location, coverage length, and your coverage limits.

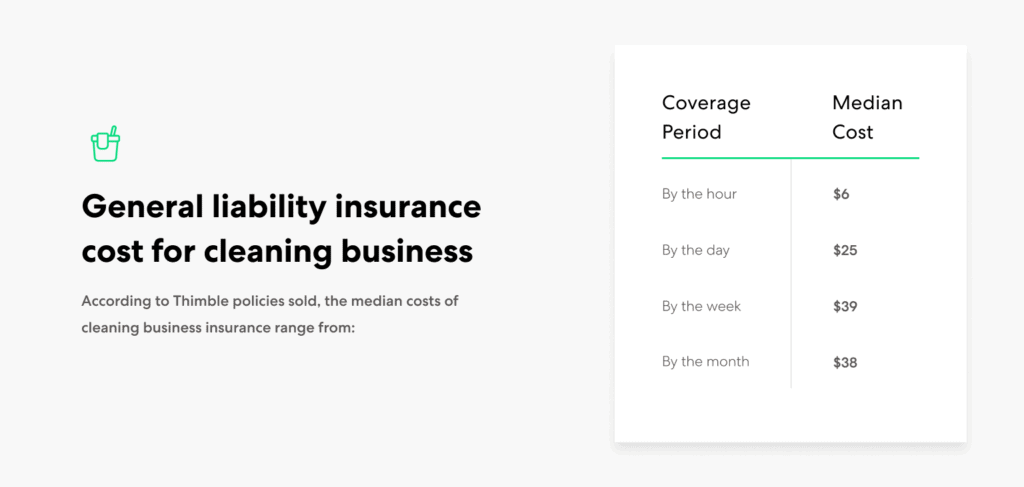

According to Thimble policies sold, the median costs of cleaning business insurance range from:

- $6 per hour

- $25 per day

- $39 per week

- $38 per month

Equipment insurance – While general liability insurance protects other people’s property, you need another type of coverage to protect your equipment. Simply called, Business Equipment Protection at Thimble covers your gear equipment that travels with you to job sites. A minor additional cost it helps protect your gear should it break down, get stolen, or vandalized while on a job.

On average, the monthly cost of Business Equipment Protection is:

- $6 per month for a $1,000 coverage limit

- $15 per month for a $2,500 coverage limit

Why do cleaners need general liability insurance?

As the most critical coverage for cleaning businesses, general liability insurance protects you against the risk of third-party liability arising out of these kinds of claims:

- Third-party property damage – Should you damage an object—whether an expensive rug or a costly speaker system—your client could sue you for property damage.

- Third-party bodily injury – Should someone slip on a freshly mopped floor or have an allergic reaction to a chemical cleaning agent, they could sue you. Keep in mind that this only covers non-employees. Workers’ compensation covers injuries or illnesses that your employees may sustain while on the job.

- Personal and advertising injury – Competitors and third-parties could sue you for libel or copyright infringement.

While general liability insurance can cover third-party property damage, it does not apply to your own property. For that, you need additional coverage, which we’ll dive into next.

Tools & equipment insurance for cleaners

For the cleaning tools and equipment you use daily, you need inland marine insurance. At Thimble, we call this coverage what it is: Business Equipment Protection.

You know it takes time and resources to build up your arsenal of cleaning equipment and tools, and why they’re worth protecting. Whether a vacuum or carpet cleaning machine catches fire or someone steals your cleaning supplies while on a job site, Business Equipment Protection can cover the cost of damage or replacement.

Typically, only the specific equipment listed on your insurance policy is covered. To make sure you don’t have to update your policy every time you buy new gear, Thimble’s Business Equipment Protection gives you blanket coverage for your tools and equipment with values less than $2,500.

Factors that influence cleaning business liability cost

What accounts for the price range in cleaning business insurance? The following all play a role in your cleaning insurance premium:

Location – Your business’s location can impact your insurance cost. For example, cleaning crews in large urban areas encounter more people on the job, which raises the risk of a claim (and therefore, your insurance rate).

Crew size – The more members in your cleaning crew, the more interactions that could result in a client or third-party lawsuit.

Specialty – As a cleaning business owner, you can specialize in carpet cleaning, boat cleaning, window cleaning and other niches. Each of these presents slightly different risks, which can impact your insurance cost.

Coverage limits – Your coverage limits are the maximum amount your insurer will cover in settlement and legal costs. More coverage naturally comes at a slightly higher price.

With Thimble, you choose between $1 million or $2 million in coverage. Based on Thimble data, 85% of cleaners choose the $1 million coverage limit, although those with larger businesses can choose a higher limit without paying double the price.

If you choose to add Business Equipment Protection, there are two coverage limits of $1,000 or $2,500, both with a $500 deductible.

Coverage term – Traditionally, you pay monthly premiums for an entire year, but at Thimble, we know you may not need coverage year-round. Thimble’s on-demand insurance makes it possible to buy coverage when you need it, helping you manage your business expenses, especially as you’re starting.

Traditionally, general liability coverage is sold as an annual policy, meaning you pay for insurance for the whole year (even if you don’t work every day). That’s why we’ve created on-demand Cleaning Business Insurance available by the hour, day, or month. That way, your cleaning insurance only works when you do.

Not only do we make insurance that works on your schedule, but we removed some costly exclusions you may not know about until it’s too late. Thimble’s Cleaning Business Insurance includes coverage for damage to a customer’s property that’s in your care.

This is often excluded by many other general liability policies. For example, if you’re using a clients’ vacuum cleaner and it breaks, with Thimble you’re covered. Most other general liability policies would not cover damage to the vacuum because it was technically in your care, even though it’s technically third-party property. (We agree – this doesn’t make sense!)

Other types of insurance for cleaning businesses

Cleaning businesses can also benefit from some additional types of insurance. Consider budgeting for them as part of your insurance coverage.

Auto liability insurance – Almost every state requires auto liability insurance, whether you drive for personal or work purposes. Cleaning business owners may use their car, small truck, or van to carry equipment to and from job sites. If the business does not own the vehicle and it is not a large commercial vehicle, your personal auto policy should suffice, which means no additional expenses! However, make sure that your insurance adequately covers you; talk with your auto insurance provider.

Workers’ compensation insurance – If you hire a crew, you’re likely required to cover them with workers’ compensation insurance. This kind of insurance coverage can help cover costs associated with employees’ on-the-job accidents or work-related illnesses.

Commercial property insurance – Do you lease a commercial space to house your cleaning equipment, or use it as your office? Make sure your business property is covered with commercial property insurance. Typically, the cost is based on the building type, age, size, and location.

Surety bond insurance – Some clients will ask you to carry a janitorial surety bond to cover claims of theft by one of your employees. Many commercial cleaning businesses buy such a surety bond.

Clean up with business insurance

Buying cleaning business insurance shields your business against messes that you might make, so you can focus on growing your business. In summary:

- Monthly cleaning business insurance typically costs $38, while on-demand insurance by the hour costs $6.

- Protect your cleaning tools with Business Equipment Protection starting at $6 per month on average.

- Ensure the vehicle you drive for work is covered with auto insurance (you might need a commercial auto insurance policy).

- Assess what other types of coverage you need to safeguard your business.

Protecting your cleaning business is as easy as breezing through a few questions. Within seconds, you can have your own customized policy and Certificate of Insurance in your inbox. With Thimble, you can clean up well (and protect your profit).