Bind on behalf of your clients directly in the portal. Extend, add Additional Insured(s), or change coverage limits quickly – no waiting around.

Quote to bind in minutes – no wait.

Automate and selfserve on-demand.

Let automated emails notify your clients of policy changes instantly, and get monthly sales summaries sent to your inbox. Self-serve everything from a real-time appetite checker to referral links, flyers, and more.

Smarter benefits for you and your clients.

Selling at the speed of small business is better. Say “yes” to new ventures. Expand your coverage offering. Both you and your clients get white glove support, and you get faster, more seamless wins.

Greenwood + Thimble FAQ

How do I get my compensation?

Compensation will be paid in accordance with your agreement. Please reach out to brokersupport@thimble.com if you have any questions about your compensation regarding policies placed through Thimble, including any referral fee payouts and bonuses.

What is the Thimble Broker Program?

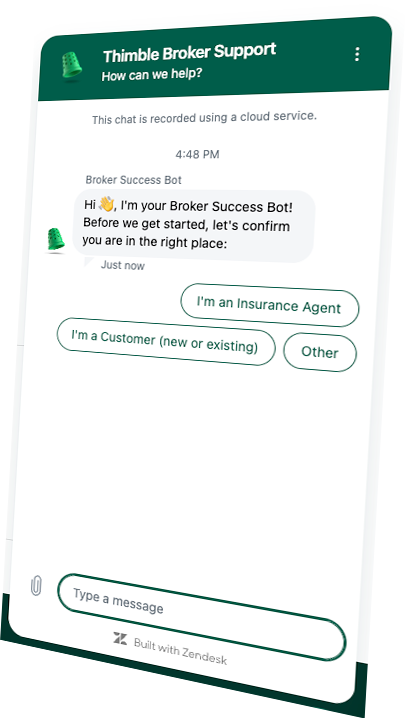

The Thimble Broker Portal makes it easy for top brokers to partner with us and bind A-rated business insurance for their clients faster than ever.

Through the Thimble Broker Portal, brokers can build and bind quotes for clients, keep track of sales, and send their unique link out to grow their book seamlessly.

And active Thimble brokers keep their clients for life; you continue to earn every policy extension or renewal.

Ready to sell at the speed of small business? Sign up now

Please note: You must be a licensed property & casualty broker in the state where you are placing business for Thimble to process referral payments and commissions.

To which clients can I sell coverage through Thimble?

Thimble offers an innovative range of insurance essentials built for small businesses and independent workers of all sizes. Coverage can be purchased from an hour to a full year, or by the month with Thimble Monthly. Small business owners want the freedom of working for themselves with flexible insurance to match, and Thimble makes it possible for hundreds of activities at any stage of their growth. See our full list of included activities here.

Product and activity availability differ by state and insurer appetite. All offerings are subject to change.

Does Thimble require its broker partners to carry their own errors and omissions insurance coverage?

Yes, Thimble requires its broker partners to carry at least $1M in cyber liability and $1M in Errors & Omissions coverage.

Who is the broker of record on policies written through Thimble?

While Thimble is the broker of record on all policies referred by affiliated brokers, Thimble makes sure that active brokers own the clients for life by paying the broker referral payments for all future extensions and renewals by the client, along with copying the affiliated broker on all transactional communications from Thimble, like cancellations, policy changes, and more.